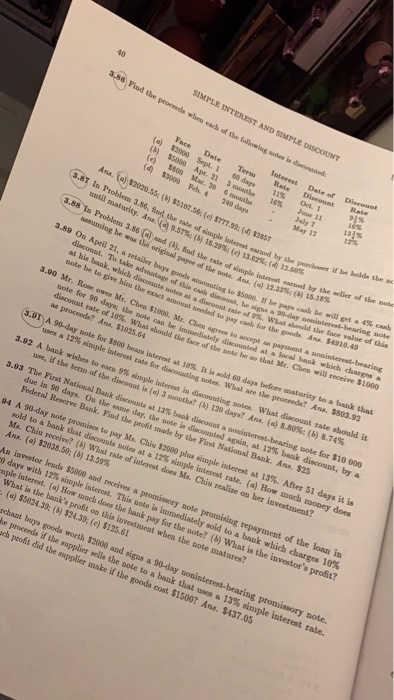

Question: 40 SIMPLE INTEREST AND SIMPLE DISCOUNT Face Date Ter Rate (a) S2000 Sept. 1 00 days 11% 16% Iaterest Date of Discouet (b) $5000 Apr.

40 SIMPLE INTEREST AND SIMPLE DISCOUNT Face Date Ter Rate (a) S2000 Sept. 1 00 days 11% 16% Iaterest Date of Discouet (b) $5000 Apr. 21 3moathe det. I Jupe 82020.38; (6) $5107.6 ) 9771 52:(4 $285 until maturity. Am(a) 9.57%; (6) 16.29%; (c) 1362%; (d) 12S, the "der of the Da Mourning he was the original payee of the note. Aru. (a) 12.33%; (s) discouat. To take advaatage of this cash dincount, be sigs should the 10.49 sote be to give him the exact asoust needed so pay parchaner if be bolde tbe x 3.88Yn Problem 3.86 (a) and (S), find the rate ofsunple interalsh (s) 15.18% 3.80 Oa April 21 retaiter y go amounting to $.00, I pays cash he will get a 4% cash 3.90 Mr. Rose owes Mr. Chea $1000. Mr. Ches agrees to alocal bnk eeive note for 90 days; the sote discount as proceeds? Ans. $1025.64 an A 90-day note for $800 bean interest al 10%. It is sold 60 days before maturity to a bank that iscouating sotes. What are the proceeds? Ans. $803.92 uses a 12% simple interest tate for d 3.92 A bank wishes to earn 9% sinsple interest in discounting notes. what discount rate should it use, if the term of the discount is (a) 3 months? (b) 120 days? Ana, (a) 8.80%, (b) 8.74% The First National Bank discounts at 13% bank discount a noninterest-bearing note for S10 000 due inse days. Onthe same day, the note 1, discounted again, at i2% bank dieount, by a 3.93 Federal Reserve Bank. Find the proit made by the First National Bank. Ans. $25 94 A 90-day note proniees to rate. (a) How much money does Ms. Chiu receive? (b) What rate of iuterest does Ms. Chiu realize on her investment? Ana. (a) $2038.50; (6) 13.59% An investor lends $5000 and receives a note prom with 12% simple interest. This note is immediately sold to a (o) $5024.39: (6) $24.39; (c) $125.61 rchaat bays goods worth $2000 and sigas a 90-day noninterest-bearing promissory note. bank which charges 10% nple interest. (o) How much does the bank pay for the note? (b) What is the What is the bank's proft on this investmest when the note matures? he proceeds if the supplier sells the note to a bank that uses a 13% simple interest rate. ch proft did the supplier make if the goods cost $1500? Ans. $437.05

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts