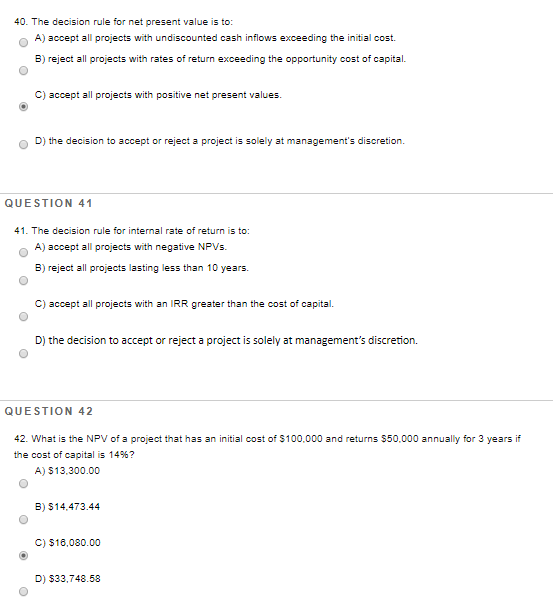

Question: 40. The decision rule for net present value is to: A) accept all projects with undiscounted cash inflows exceeding the initial cost. B) reject all

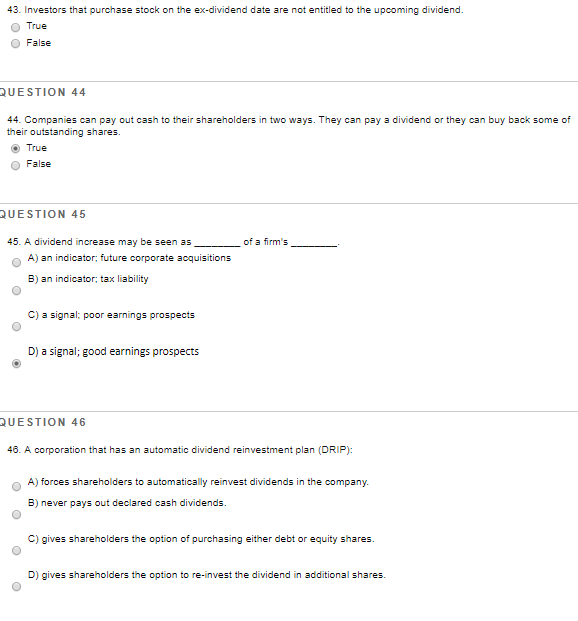

40. The decision rule for net present value is to: A) accept all projects with undiscounted cash inflows exceeding the initial cost. B) reject all projects with rates of return exceeding the opportunity cost of capital. C) accept all projects with positive net present values D) the decision to accept or reject a project is solely at management's discretion QUESTION 41 41. The decision rule for internal rate of return is to: A) accept all projects with negative NPVs. B) reject all projects lasting less than 10 years. C) accept all projects with an IRR greater than the cost of capital. D) the decision to accept or reject a project is solely at management's discretion. QUESTION 42 42. What is the NPV of a project that has an initial cost of $100.000 and returns $50.000 annually for 3 years if the cost of capital is 149? A) 513,300.00 B) $14.473.44 C) $16,080.00 D) $33,748.58 43. Investors that purchase stock on the ex-dividend date are not entitled to the upcoming dividend. True False QUESTION 44 44. Companies can pay out cash to their shareholders in two ways. They can pay a dividend or they can buy back some of their outstanding shares. True False QUESTION 45 of a firm's ___ 45. A dividend increase may be seen as __ A) an indicator; future corporate acquisitions B) an indicator: tax liability C) a signal: poor earnings prospects D) a signal; good earnings prospects QUESTION 46 46. A corporation that has an automatic dividend reinvestment plan (DRIP): A) forces shareholders to automatically reinvest dividends in the company B) never pays out declared cash dividends. C) gives shareholders the option of purchasing either debt or equity shares. D) gives shareholders the option to re-invest the dividend in additional shares

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts