Question: 40. Widget, Inc. has 2 shareholders, A & B. Both own 500 shares of common stock. A's basis in his shares is $600,000 an basis

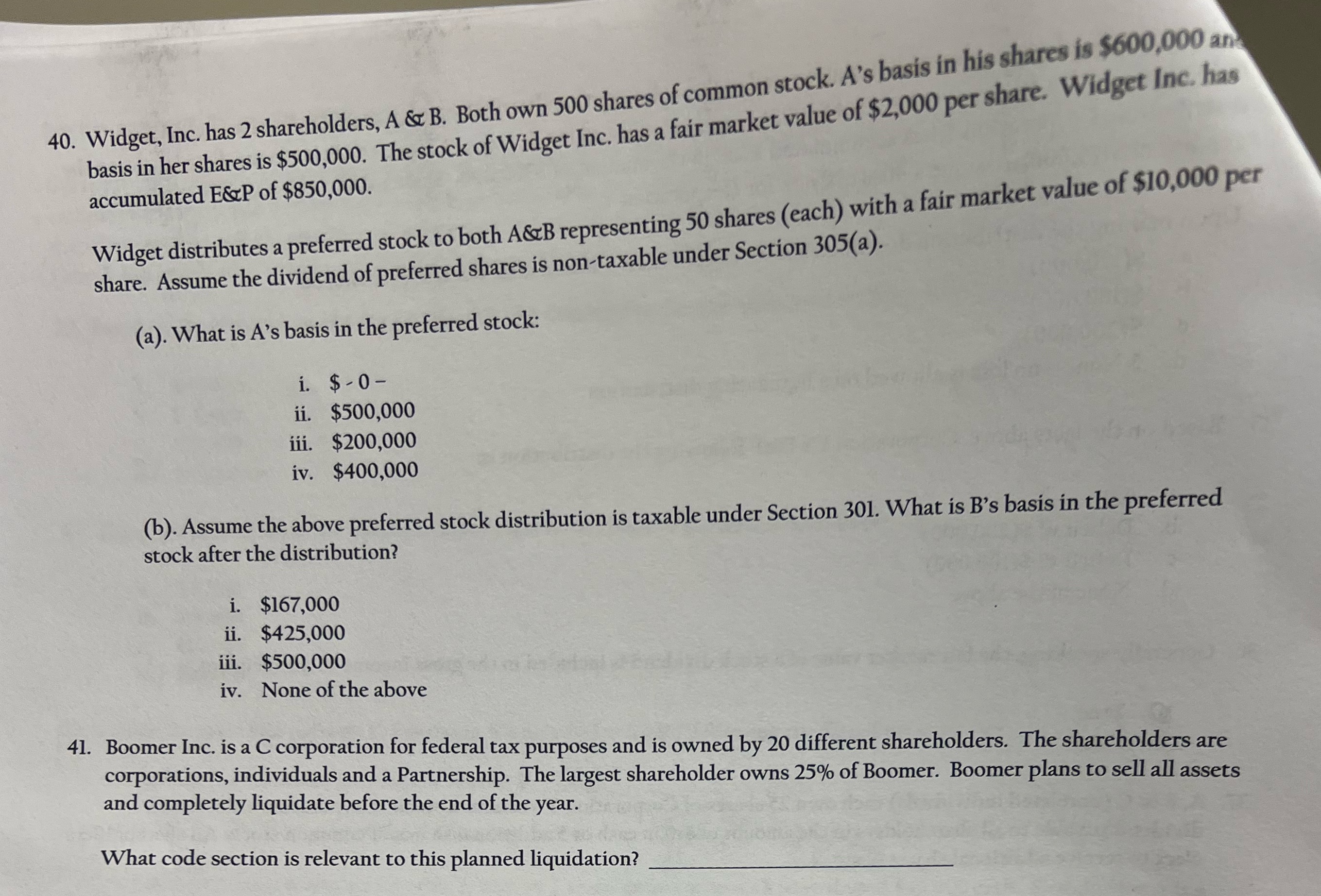

40. Widget, Inc. has 2 shareholders, A & B. Both own 500 shares of common stock. A's basis in his shares is $600,000 an basis in her shares is $500,000. The stock of Widget Inc. has a fair market value of $2,000 per share. Widget Inc. has accumulated E&P of $850,000. Widget distributes a preferred stock to both A&B representing 50 shares (each) with a fair market value of $10,000 per share. Assume the dividend of preferred shares is non-taxable under Section 305(a). (a). What is A's basis in the preferred stock: i. $ - 0- ii. $500,000 iii. $200,000 iv. $400,000 (b). Assume the above preferred stock distribution is taxable under Section 301. What is B's basis in the preferred stock after the distribution? i. $167,000 ii. $425,000 iii. $500,000 iv. None of the above 41. Boomer Inc. is a C corporation for federal tax purposes and is owned by 20 different shareholders. The shareholders are corporations, individuals and a Partnership. The largest shareholder owns 25% of Boomer. Boomer plans to sell all assets and completely liquidate before the end of the year. What code section is relevant to this planned liquidation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts