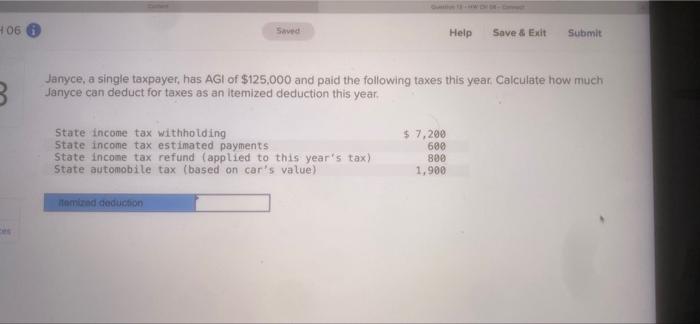

Question: 406 Help Save & Exit Submit 3. Janyce, a single taxpayer, has AG of $125,000 and paid the following taxes this year Calculate how much

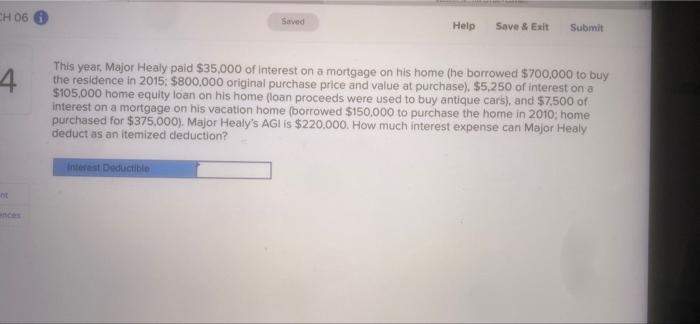

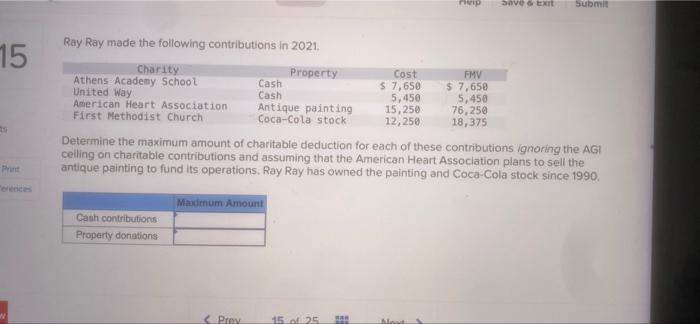

406 Help Save & Exit Submit 3. Janyce, a single taxpayer, has AG of $125,000 and paid the following taxes this year Calculate how much Janyce can deduct for taxes as an itemized deduction this year. $ 7,200 600 State income tax withholding State income tax estimated payments State income tax refund (applied to this year's tax) State automobile tax (based on car's value) 800 1,900 Tomlined deduction H06 Saved Help Save & Exit Submit This year, Major Healy paid $35,000 of Interest on a mortgage on his home (he borrowed $700,000 to buy the residence in 2015; $800,000 original purchase price and value at purchase). $5,250 of interest on a $105,000 home equity loan on his home loan proceeds were used to buy antique cars), and $7.500 of Interest on a mortgage on his vacation home (borrowed $150,000 to purchase the home in 2010; home purchased for $375,000). Major Healy's AGI is $220,000. How much interest expense can Major Healy deduct as an itemized deduction? Interest Deductible ht RIP save att Submit 15 Ray Ray made the following contributions in 2021 Charity Property Cost FMV Athens Academy School Cash $ 7,650 $ 7,650 United Way Cash 5,450 5,450 American Heart Association Antique painting 15,258 76,250 First Methodist Church Coca-Cola stock 12,250 18,375 Determine the maximum amount of charitable deduction for each of these contributions ignoring the AGI ceiling on charitable contributions and assuming that the American Heart Association plans to sell the antique painting to fund its operations, Ray Ray has owned the painting and Coca-Cola stock since 1990. Pront Maximum Amount Cash contributions Property donations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts