Question: 4.1 Discussion Post . Instructions Respond to the topic below by Sunday, September 20, 11:59 pm EST by posting your response to the discuss board

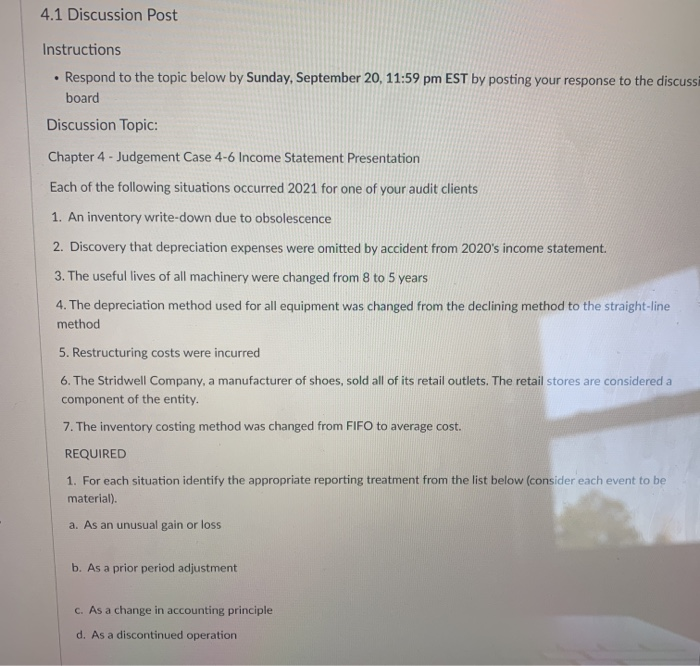

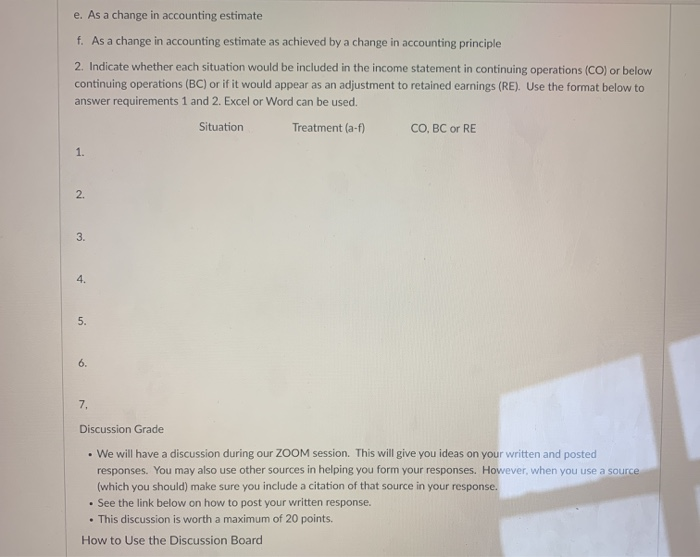

4.1 Discussion Post . Instructions Respond to the topic below by Sunday, September 20, 11:59 pm EST by posting your response to the discuss board Discussion Topic: Chapter 4 - Judgement Case 4-6 Income Statement Presentation Each of the following situations occurred 2021 for one of your audit clients 1. An inventory write-down due to obsolescence 2. Discovery that depreciation expenses were omitted by accident from 2020's income statement. 3. The useful lives of all machinery were changed from 8 to 5 years 4. The depreciation method used for all equipment was changed from the declining method to the straight-line method 5. Restructuring costs were incurred 6. The Stridwell Company, a manufacturer of shoes, sold all of its retail outlets. The retail stores are considered a component of the entity. 7. The inventory costing method was changed from FIFO to average cost. REQUIRED 1. For each situation identify the appropriate reporting treatment from the list below (consider each event to be material). a. As an unusual gain or loss b. As a prior period adjustment c. As a change in accounting principle d. As a discontinued operation e. As a change in accounting estimate f. As a change in accounting estimate as achieved by a change in accounting principle 2. Indicate whether each situation would be included in the income statement in continuing operations (CO) or below continuing operations (BC) or if it would appear as an adjustment to retained earnings (RE). Use the format below to answer requirements 1 and 2. Excel or Word can be used. Situation Treatment (a-f) CO.BC or RE 1. 2. 3. 4. 5. 6. 7. Discussion Grade . We will have a discussion during our ZOOM session. This will give you ideas on your written and posted responses. You may also use other sources in helping you form your responses. However, when you use a source (which you should) make sure you include a citation of that source in your response. See the link below on how to post your written response. . This discussion is worth a maximum of 20 points. How to Use the Discussion Board

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts