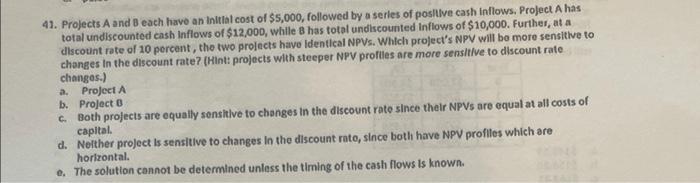

Question: 41. Projects A and B each have an Inittal cost of $5,000, followed by a serles of posltive cash inflows. Project A has total undiscounted

41. Projects A and B each have an Inittal cost of $5,000, followed by a serles of posltive cash inflows. Project A has total undiscounted cash inflows of $12,000, whille 8 has total undiscounted inflows of $10,000. Further, at a discotint rate of 10 percent, the two prolects have Identlcal NPVs. Which project's NPV will bo more sensitive to chonges In the discount rate? (Hint: projects with steeper NPV profiles are more sensitive to discount rate. changes.) a. Project A b. Prolect B C. Both projects are equally sensitive to changes in the discount rate since their NPVs are equal at all costs of capital. d. Nelther project is sensitive to changes in the discount rato, since both have NPV proflles which are horizontal. e. The solution cannot be determined unless the timing of the cash flows is known

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts