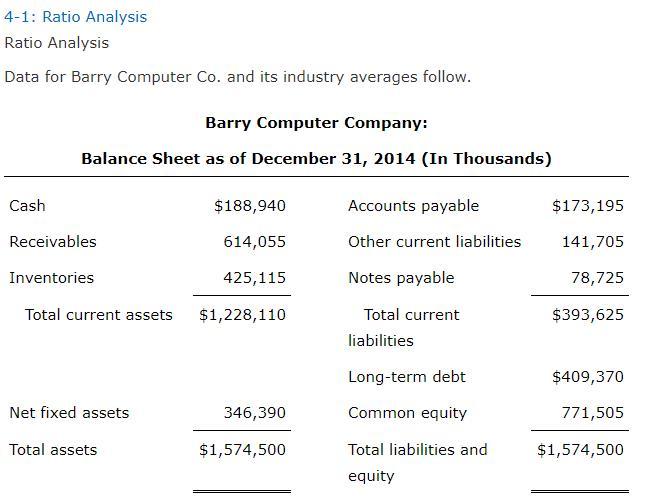

Question: 4-1: Ratio Analysis Ratio Analysis Data for Barry Computer Co. and its industry averages follow. Barry Computer Company: Balance Sheet as of December 31, 2014

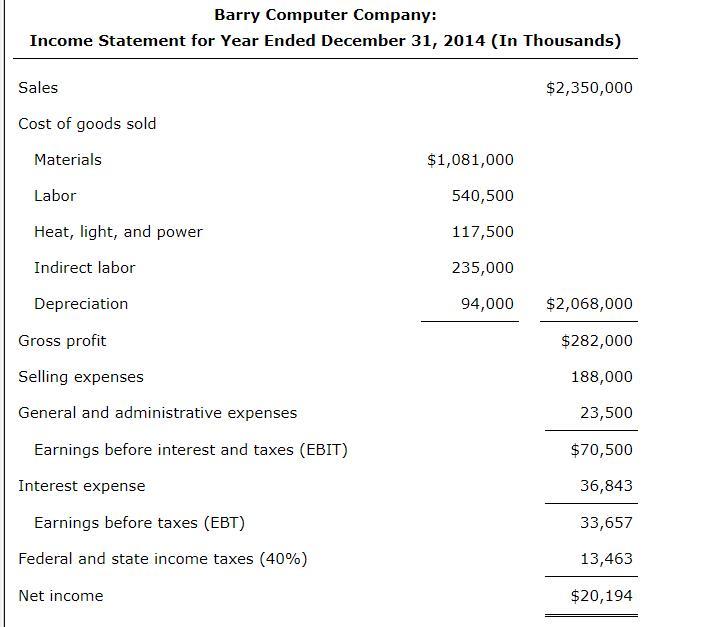

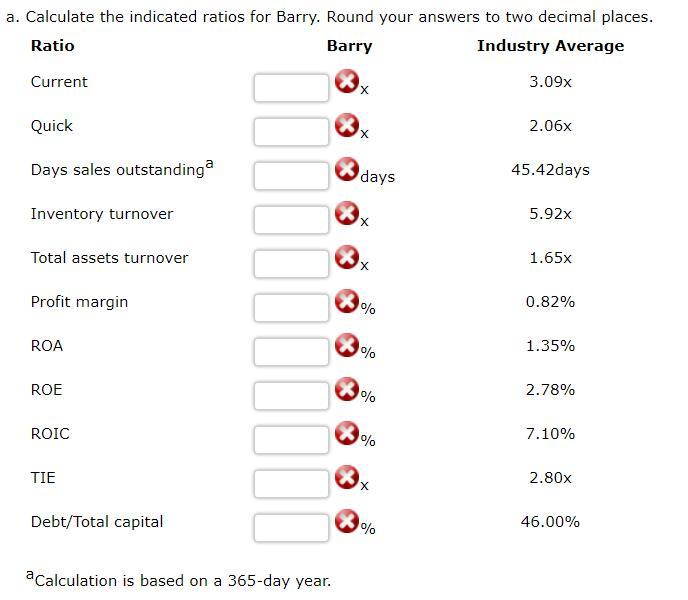

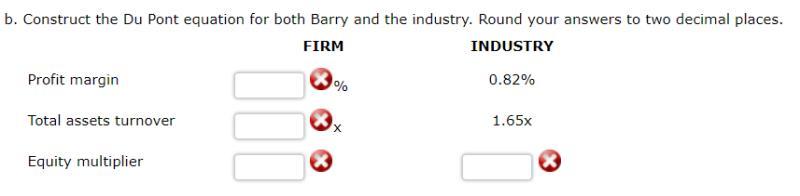

4-1: Ratio Analysis Ratio Analysis Data for Barry Computer Co. and its industry averages follow. Barry Computer Company: Balance Sheet as of December 31, 2014 (In Thousands) Cash $188,940 Accounts payable $173,195 Receivables 614,055 Other current liabilities 141,705 Inventories 425,115 Notes payable 78,725 Total current assets $1,228,110 $393,625 Total current liabilities Long-term debt $409,370 Net fixed assets 346,390 Common equity 771,505 Total assets $1,574,500 $1,574,500 Total liabilities and equity Barry Computer Company: Income Statement for Year Ended December 31, 2014 (In Thousands) Sales $2,350,000 Cost of goods sold Materials $1,081,000 Labor 540,500 Heat, light, and power 117,500 Indirect labor 235,000 Depreciation 94,000 $2,068,000 Gross profit $282,000 Selling expenses 188,000 General and administrative expenses 23,500 Earnings before interest and taxes (EBIT) $70,500 Interest expense 36,843 Earnings before taxes (EBT) 33,657 Federal and state income taxes (40%) 13,463 Net income $20,194 a. Calculate the indicated ratios for Barry. Round your answers to two decimal places. Ratio Barry Industry Average Current 3.09x Quick 2.06x x Days sales outstandinga days 45.42days Inventory turnover x 5.92x Total assets turnover 1.65x Profit margin % 0.82% ROA % 1.35% ROE 2.78% % ROIC % 7.10% TIE 2.80x Debt/Total capital % 46.00% a calculation is based on a 365-day year. b. Construct the Du Pont equation for both Barry and the industry. Round your answers to two decimal places. FIRM INDUSTRY Profit margin % 0.82% Total assets turnover 1.65x Equity multiplier

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts