Question: 4-1 Time Line Show the time line for a S and a 10 percent interest rate. (LG4-1) 500 cash inlow today, a $605 cash outflow

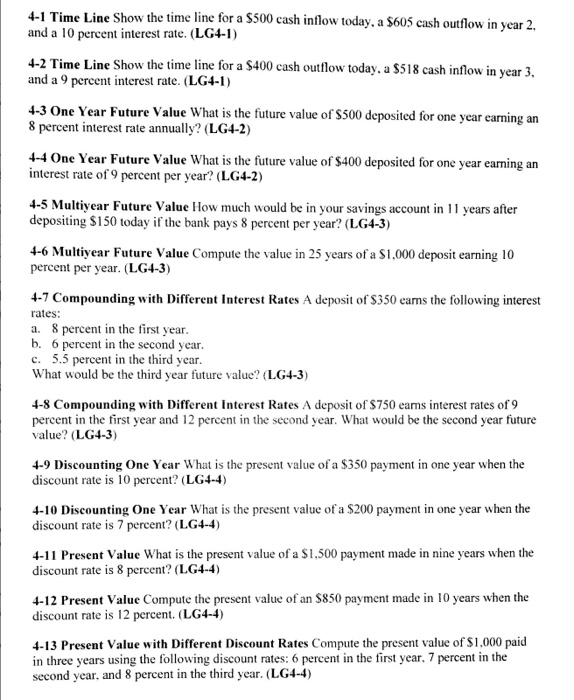

4-1 Time Line Show the time line for a S and a 10 percent interest rate. (LG4-1) 500 cash inlow today, a $605 cash outflow in year 2 4-2 Time Line Show the time line for a $400 cash outflow today, a $518 cash inflow in year 3. and a 9 percent interest rate. (LG4-1) 4-3 One Year Future Value What is the future value of S500 deposited for one year earning an 8 percent interest rate annually? (LG4-2) 4-4 One Year Future Value What is the future value of $400 deposited for one year earning an interest rate of9 percent per year? (LG4-2) 4-5 Multiyear Future Value How much would be in your savings account in 11 years after depositing $150 today if the bank pays 8 percent per year? (LG4-3) 4-6 Multiyear Future Value Compute the value in 25 years of a S1,000 deposit earning 10 percent per year. (LG4-3) 4-7 Compounding with Different Interest Rates A deposit of S350 eams the following interest rates: a. 8 percent in the first year b. 6 percent in the second year c. 5.5 percent in the third year What would be the third year future value? (LG4-3) 4-8 Compounding with Different Interest Rates A depost of $750 earns interest rates of 9 percent in the first year and 12 percent in the second year. What would be the second year future value? (LG4-3) 4-9 Discounting One Year What is the present value of a $350 payment in one year when the discount rate is 10 percent? (LG4-4) 4-10 Discounting One Year What is the present value of a $200 payment in one year when the discount rate is 7 percent? (LG4-4) 4-11 Present Value What is the present value of a S1.500 payment made in nine years when the discount rate is 8 percent? (LG4-4) 4-12 Present Value Compute the present value of an S850 payment made in 10 years when the discount rate is 12 percent. (LG4-4) 4-13 Present Value with Different Discount Rates Compute the present value of $1,000 paid in three years using the following discount rates: 6 percent in the first year, 7 percent in the second year, and 8 percent in the third year. (LG4-4) 4-1 Time Line Show the time line for a S and a 10 percent interest rate. (LG4-1) 500 cash inlow today, a $605 cash outflow in year 2 4-2 Time Line Show the time line for a $400 cash outflow today, a $518 cash inflow in year 3. and a 9 percent interest rate. (LG4-1) 4-3 One Year Future Value What is the future value of S500 deposited for one year earning an 8 percent interest rate annually? (LG4-2) 4-4 One Year Future Value What is the future value of $400 deposited for one year earning an interest rate of9 percent per year? (LG4-2) 4-5 Multiyear Future Value How much would be in your savings account in 11 years after depositing $150 today if the bank pays 8 percent per year? (LG4-3) 4-6 Multiyear Future Value Compute the value in 25 years of a S1,000 deposit earning 10 percent per year. (LG4-3) 4-7 Compounding with Different Interest Rates A deposit of S350 eams the following interest rates: a. 8 percent in the first year b. 6 percent in the second year c. 5.5 percent in the third year What would be the third year future value? (LG4-3) 4-8 Compounding with Different Interest Rates A depost of $750 earns interest rates of 9 percent in the first year and 12 percent in the second year. What would be the second year future value? (LG4-3) 4-9 Discounting One Year What is the present value of a $350 payment in one year when the discount rate is 10 percent? (LG4-4) 4-10 Discounting One Year What is the present value of a $200 payment in one year when the discount rate is 7 percent? (LG4-4) 4-11 Present Value What is the present value of a S1.500 payment made in nine years when the discount rate is 8 percent? (LG4-4) 4-12 Present Value Compute the present value of an S850 payment made in 10 years when the discount rate is 12 percent. (LG4-4) 4-13 Present Value with Different Discount Rates Compute the present value of $1,000 paid in three years using the following discount rates: 6 percent in the first year, 7 percent in the second year, and 8 percent in the third year. (LG4-4)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts