Question: 41. Under the alimony rules: a. To determine whether a cash payment is alimony, one must consult the state laws that define alimony b. A

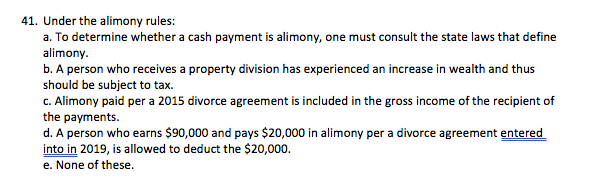

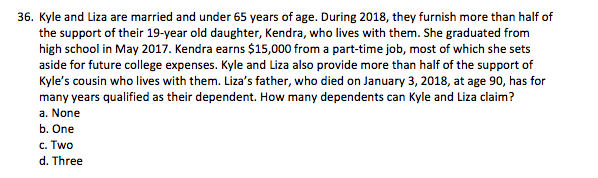

41. Under the alimony rules: a. To determine whether a cash payment is alimony, one must consult the state laws that define alimony b. A person who receives a property division has experienced an increase in wealth and thus should be subject to tax. c. Alimony paid per a 2015 divorce agreement is included in the gross income of the recipient of the payments. d. A person who earns $90,000 and pays $20,000 in alimony per a divorce agreement entered into in 2019, is allowed to deduct the $20,000. e. None of these 36. Kyle and Liza are married and under 65 years of age. During 2018, they furnish more than half of the support of their 19-year old daughter, Kendra, who lives with them. She graduated from high school in May 2017. Kendra earns $15,000 from a part-time job, most of which she sets aside for future college expenses. Kyle and Liza also provide more than half of the support of Kyle's cousin who lives with them. Liza's father, who died on January 3, 2018, at age 90, has for many years qualified as their dependent. How many dependents can Kyle and Liza claim? a. None b. One c. Two d. Three

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts