Question: 42. Gull Corp. is considering selling its old popcorn machine and replacing it with a newer one. The old machine has a book value of

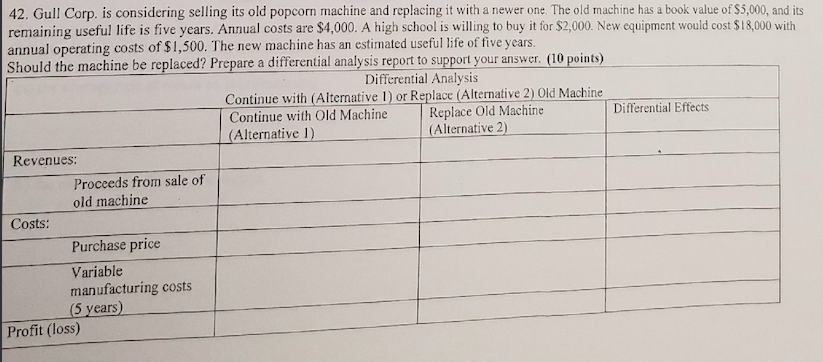

42. Gull Corp. is considering selling its old popcorn machine and replacing it with a newer one. The old machine has a book value of $5,000, and its remaining useful life is five years. Annual costs are $4,000. A high school is willing to buy it for $2,000. New equipment would cost $18,000 with annual operating costs of $1,500. The new machine has an estimated useful life of five years. Should the machine be replaced? Prepare a differential analysis report to support your answer. (10 points) Differential Analysis Continue with (Alternative 1) or Replace (Alternative 2) Old Machine Continue with Old Machine Replace Old Machine Differential Effects (Alternative 1) (Alternative 2) Revenues: Proceeds from sale of old machine Costs: Purchase price Variable manufacturing costs (5 years) Profit (loss)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts