Question: 4.20 Market Multiples and Reverse Engineering Share Prices. In 2000, Enron enjoyed remarkable success in the capital markets. During that year, Enron's shares increased in

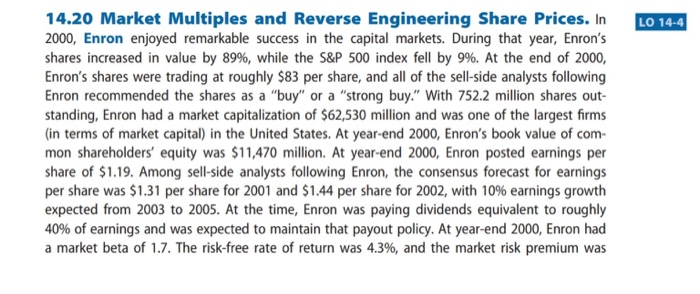

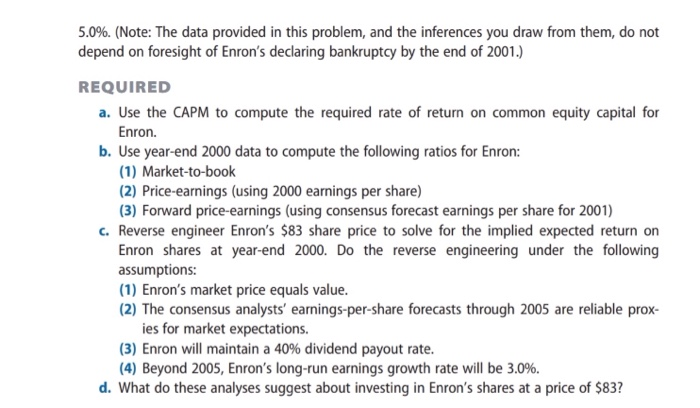

4.20 Market Multiples and Reverse Engineering Share Prices. In 2000, Enron enjoyed remarkable success in the capital markets. During that year, Enron's shares increased in value by 89%, while the S&P 500 index fell by 9%. At the end of 2000, Enron's shares were trading at roughly $83 per share, and all of the sell-side analysts following Enron recommended the shares as a "buy" or a "strong buy." With 752.2 million shares out- standing, Enron had a market capitalization of $62,530 million and was one of the largest firms (in terms of market capital) in the United States. At year-end 2000, Enron's book value of com- mon shareholders' equity was $11,470 million. At year-end 2000, Enron posted earnings per share of $1.19. Among sell-side analysts following Enron, the consensus forecast for earnings per share was $1.31 per share for 2001 and $1.44 per share for 2002, with 10% earnings growth expected from 2003 to 2005. At the time, Enron was paying dividends equivalent to roughly 40% of earnings and was expected to maintain that payout policy. At year-end 2000, Enron had a market beta of 1.7. The risk-free rate of return was 4.3%, and the market risk premium was LO 14-4 9 5.0%. (Note: The data provided in this problem, and the inferences you draw from them, do not depend on foresight of Enron's declaring bankruptcy by the end of 2001.) REQUIRED . Uhe the CAPM to compute the required rate of retum on commoeq Enron. b. Use year-end 2000 data to compute the following ratios for Enron: (1) Market-to-book (2) Price-earnings (using 2000 earnings per share) (3) Forward price-earnings (using consensus forecast earnings per share for 2001) c. Reverse engineer Enron's $83 share price to solve for the implied expected return on Enron shares at year-end 2000. Do the reverse engineering under the following assumptions: 1) Enron's market price equals value. (2) The consensus analysts' earnings-per-share forecasts through 2005 are reliable prox- ies for market expectations (3) Enron will maintain a 40% dividend payout rate. (4) Beyond 2005, Enron's long-run earnings growth rate will be 30%. d. What do these analyses suggest about investing in Enron's shares at a price of $83? 4.20 Market Multiples and Reverse Engineering Share Prices. In 2000, Enron enjoyed remarkable success in the capital markets. During that year, Enron's shares increased in value by 89%, while the S&P 500 index fell by 9%. At the end of 2000, Enron's shares were trading at roughly $83 per share, and all of the sell-side analysts following Enron recommended the shares as a "buy" or a "strong buy." With 752.2 million shares out- standing, Enron had a market capitalization of $62,530 million and was one of the largest firms (in terms of market capital) in the United States. At year-end 2000, Enron's book value of com- mon shareholders' equity was $11,470 million. At year-end 2000, Enron posted earnings per share of $1.19. Among sell-side analysts following Enron, the consensus forecast for earnings per share was $1.31 per share for 2001 and $1.44 per share for 2002, with 10% earnings growth expected from 2003 to 2005. At the time, Enron was paying dividends equivalent to roughly 40% of earnings and was expected to maintain that payout policy. At year-end 2000, Enron had a market beta of 1.7. The risk-free rate of return was 4.3%, and the market risk premium was LO 14-4 9 5.0%. (Note: The data provided in this problem, and the inferences you draw from them, do not depend on foresight of Enron's declaring bankruptcy by the end of 2001.) REQUIRED . Uhe the CAPM to compute the required rate of retum on commoeq Enron. b. Use year-end 2000 data to compute the following ratios for Enron: (1) Market-to-book (2) Price-earnings (using 2000 earnings per share) (3) Forward price-earnings (using consensus forecast earnings per share for 2001) c. Reverse engineer Enron's $83 share price to solve for the implied expected return on Enron shares at year-end 2000. Do the reverse engineering under the following assumptions: 1) Enron's market price equals value. (2) The consensus analysts' earnings-per-share forecasts through 2005 are reliable prox- ies for market expectations (3) Enron will maintain a 40% dividend payout rate. (4) Beyond 2005, Enron's long-run earnings growth rate will be 30%. d. What do these analyses suggest about investing in Enron's shares at a price of $83

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts