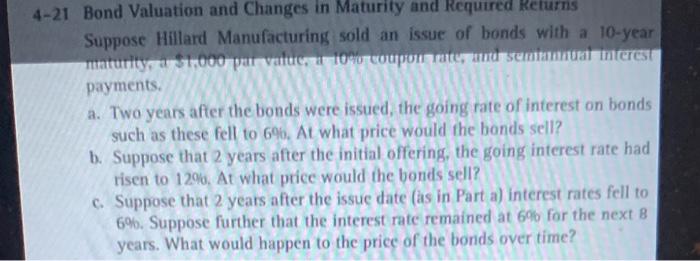

Question: 4-21 Bond Valuation and Changes in Maturity and Required Returns Suppose Hillard Manufacturing sold an issue of bonds with a 10-year maturity 1.000 pu valu,

4-21 Bond Valuation and Changes in Maturity and Required Returns Suppose Hillard Manufacturing sold an issue of bonds with a 10-year maturity 1.000 pu valu, 100 coupon rate, uma semana mereu payments. a. Two years after the bonds were issued, the going rate of interest on bonds such as these fell to 6%. At what price would the bonds sell? b. Suppose that 2 years after the initial offering, the going interest rate had risen to 12%. At what price would the bonds sell? c. Suppose that 2 years after the issue date (as in Part a) interest rates fell to 6%. Suppose further that the interest rate remained at 6% for the next B years. What would happen to the price of the bonds over time

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts