Question: 4.29% O-5.19% Question 13 1 pts A project's expected return is 15%, which represents a 35% return in a booming economy and a 5% return

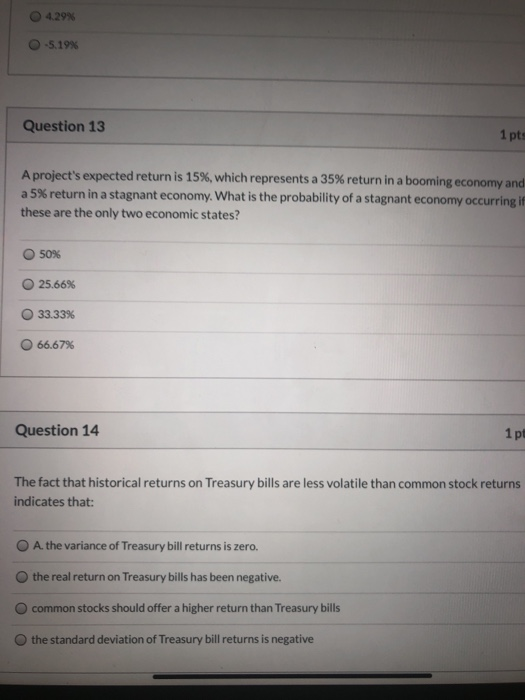

4.29% O-5.19% Question 13 1 pts A project's expected return is 15%, which represents a 35% return in a booming economy and a 5% return in a stagnant economy. What is the probability of a stagnant economy occurring if these are the only two economic states? 50% 25.66% 33.33% 66.67% Question 14 The fact that historical returns on Treasury bills are less volatile than common stock returns indicates that: O A. the variance of Treasury bill returns is zero. the real return on Treasury bills has been negative. O common stocks should offer a higher return than Treasury bills the standard deviation of Treasury bill returns is negative

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts