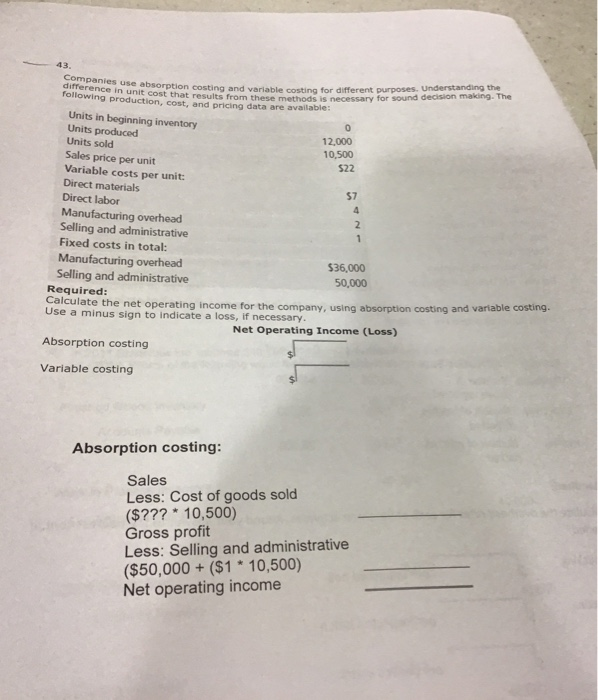

Question: 43 Companies use absorption costing and variable costing for different difference in unit cost that results from these methods is necessary Tor following production, cost,

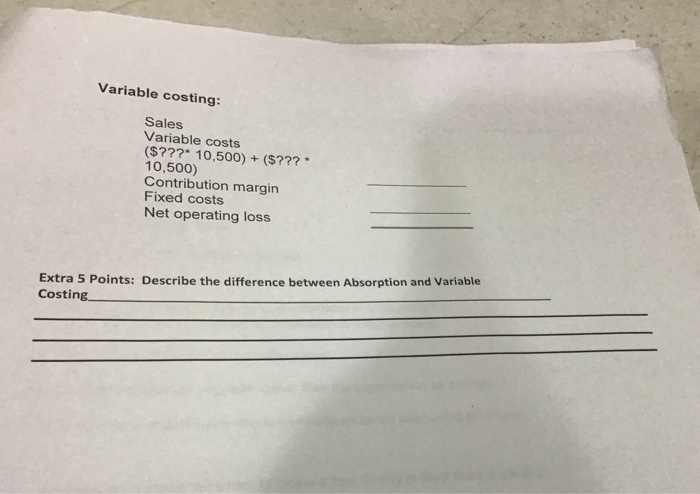

43 Companies use absorption costing and variable costing for different difference in unit cost that results from these methods is necessary Tor following production, cost, and pricing data are available: purposes. Understanding the Units in beginning inventory Units produced Units sold Sales price per unit Variable costs per unit: Direct materials Direct labor Manufacturing overhead Selling and administrative Fixed costs in total: 12,000 10,500 S22 S7 Manufacturing overhead Selling and administrative 36,000 50,000 Required: Use a minus sign to indicate a loss, if necessary. Absorption costing Variable costing late the net operating income for the company, using absorption costing and variable costing. Net Operating Income (Loss) Absorption costing: Sales Less: Cost of goods sold ($??? 10,500) Gross proft Less: Selling and administrative ($50,000+ ($1 10,500) Net operating income Variable costing: Sales Variable costs ($???* 10,500)+ ($??? 10,500) Contribution margin Fixed costs Net operating loss Extra 5 Points: Describe the difference between Absorption and Variable Costing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts