Question: 4-3 question 2 https://ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnev ework: Chapter 5 (Sections 5.1 through 5.5) Saved Help Check my work mode : This shows what is correct or incorrect

4-3 question 2

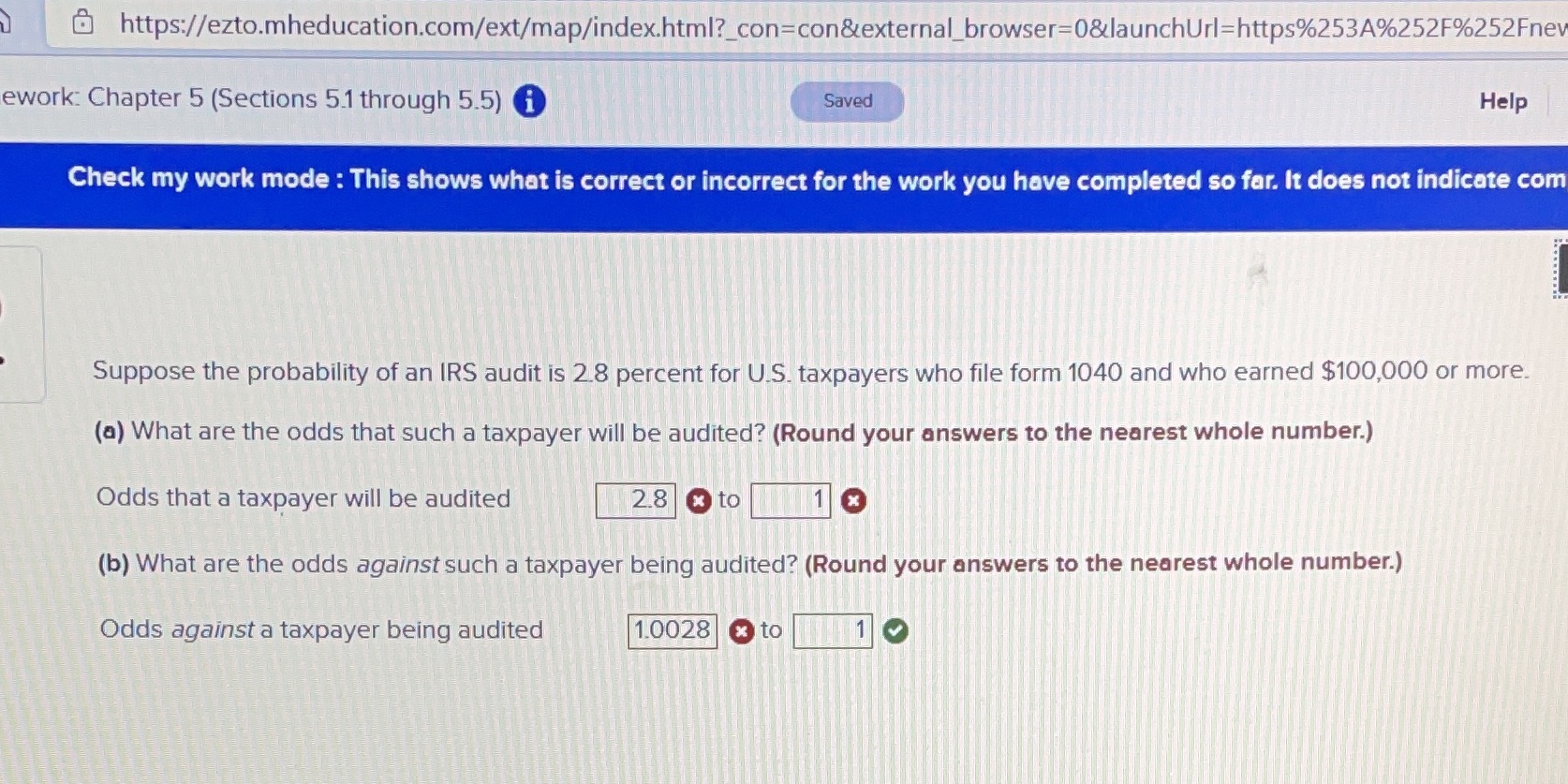

https://ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnev ework: Chapter 5 (Sections 5.1 through 5.5) Saved Help Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate com Suppose the probability of an IRS audit is 2.8 percent for U.S. taxpayers who file form 1040 and who earned $100,000 or more. (a) What are the odds that such a taxpayer will be audited? (Round your answers to the nearest whole number.) Odds that a taxpayer will be audited 2.8 x to (b) What are the odds against such a taxpayer being audited? (Round your answers to the nearest whole number.) Odds against a taxpayer being audited 10028 x to

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts