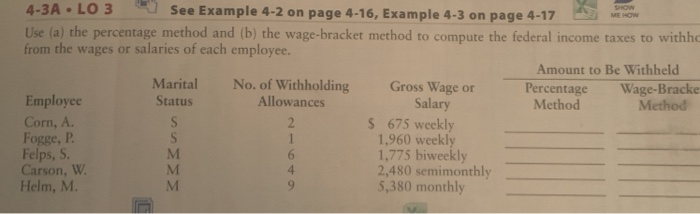

Question: 4-3A .LO3 See Example 4-2 on page 4-16, Example 4-3 on page 4-17 Use (a) the percentage method and (b) the wage-bracket method to compute

4-3A .LO3 See Example 4-2 on page 4-16, Example 4-3 on page 4-17 Use (a) the percentage method and (b) the wage-bracket method to compute the federal income taxes to withhe from the wages or salaries of each employee. Amount to Be Withheld Marital No. of Withholding Gross Wage or Percentage Wage-Bracke Salary Employee Corm, A. Fogge, P Felps, S Carson, W. Helm, M. Status Allowances Method Method S 675 weekly 1,960 weekly 1,775 biweekly 2,480 semimonthl 5,380 monthly 4 4-3A .LO3 See Example 4-2 on page 4-16, Example 4-3 on page 4-17 Use (a) the percentage method and (b) the wage-bracket method to compute the federal income taxes to withhe from the wages or salaries of each employee. Amount to Be Withheld Marital No. of Withholding Gross Wage or Percentage Wage-Bracke Salary Employee Corm, A. Fogge, P Felps, S Carson, W. Helm, M. Status Allowances Method Method S 675 weekly 1,960 weekly 1,775 biweekly 2,480 semimonthl 5,380 monthly 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts