Question: 44) The journal entry to record the payroll for a period will include a a) Credit to Wages Payable for gross earnings b) Credit to

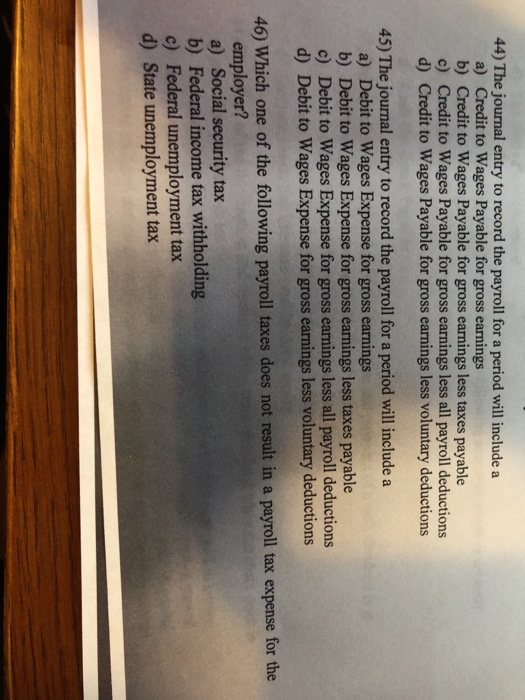

44) The journal entry to record the payroll for a period will include a a) Credit to Wages Payable for gross earnings b) Credit to Wages Payable for gross earnings less taxes payable c) Credit to Wages Payable for gross earnings less all payroll deductions d) Credit to Wages Payable for gross earnings less voluntary deductions 45) The journal entry to record the payroll for a period will include a a) Debit to Wages Expense for gross earnings b) Debit to Wages Expense for gross earnings less taxes payable c) Debit to Wages Expense for gross earnings less all payroll deductions d) Debit to Wages Expense for gross earnings less voluntary deductions 46) Which one of the following payroll taxes does not result in a payroll tax expense for the employer? a) Social security tax b) Federal income tax withholding c) Federal unemployment tax d) State unemployment tax

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts