Question: 44. Which would be an appropriate cost driver for the purchasing activity cost pool? A) Purchase orders B) Machine setups C) Machine hours D) Inspections

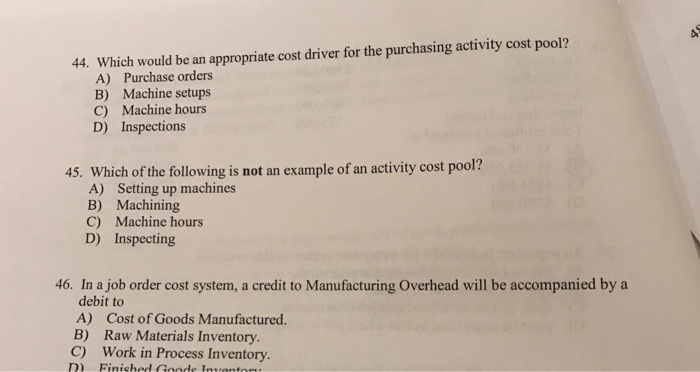

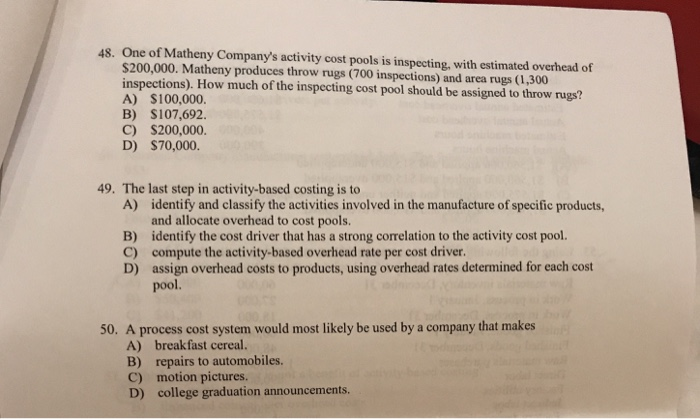

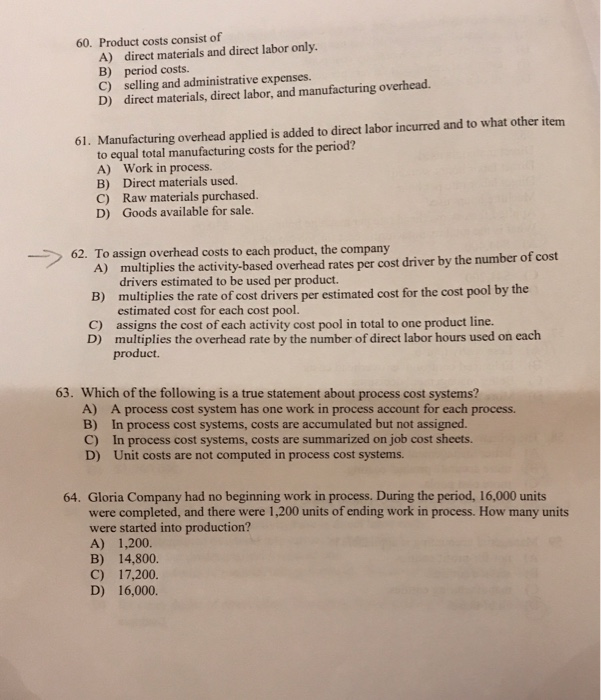

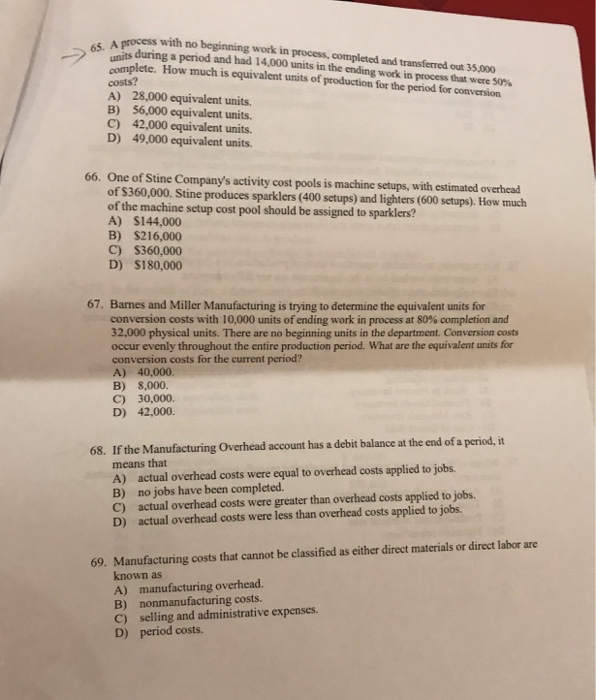

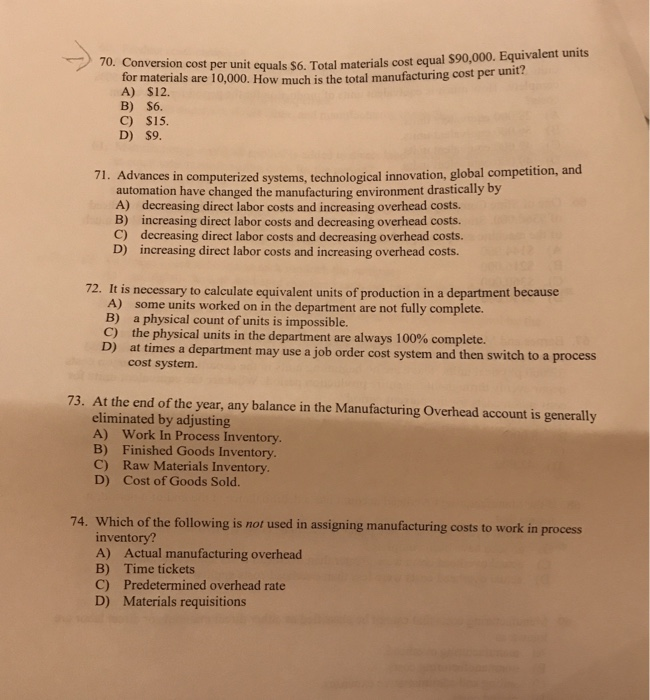

44. Which would be an appropriate cost driver for the purchasing activity cost pool? A) Purchase orders B) Machine setups C) Machine hours D) Inspections 45. Which of the following is not an example of an activity cost pool? A) Setting up machines B) Machining C) Machine hours D) Inspecting 46. In a job order cost system, a credit to Manufacturing Overhead will be accompanied by a debit to A) Cost of Goods Manufactured. B) Raw Materials Inventory. C) Work in Process Inventory. D) Finished Goode Inventor 48. One of Matheny Company's activity cost pools is inspecting, with estimated overhead of $200,000. Matheny produces throw rugs (700 inspections) and area rugs (1,300 inspections). How much of the inspecting cost pool should be assigned to throw rugs? A) $100,000. B) S107,692. C) $200,000. D) $70,000. 49. The last step in activity-based costing is to A) identify and classify the activities involved in the manufacture of specific products, and allocate overhead to cost pools. B) identify the cost driver that has a strong correlation to the activity cost pool. C) compute the activity-based overhead rate per cost driver. D) assign overhead costs to products, using overhead rates determined for each cost pool 50. A process cost system would most likely be used by a company that makes A) breakfast cereal. B) repairs to automobiles. C) motion pictures. D) college graduation announcements 60. Product costs consist of A) direct materials and direct labor only. B) period costs. C) selling and administrative expenses. D) direct materials, direct labor, and manufacturing overhead. 61. Manufacturing overhead applied is added to direct labor incurred and to what other item to equal total manufacturing costs for the period? A) Work in process. B) Direct materials used. C) Raw materials purchased. D) Goods available for sale. 62. To assign overhead costs to each product, the company A) multiplies the activity-based overhead rates per cost driver by the number of cost drivers estimated to be used per product. B) multiplies the rate of cost drivers per estimated cost for the cost pool by the estimated cost for each cost pool. assigns the cost of each activity cost pool in total to one product line. D) multiplies the overhead rate by the number of direct labor hours used on each product. 63. Which of the following is a true statement about process cost systems? A) A process cost system has one work in process account for each process. B) In process cost systems, costs are accumulated but not assigned. C) In process cost systems, costs are summarized on job cost sheets. D) Unit costs are not computed in process cost systems. 64. Gloria Company had no beginning work in process. During the period, 16,000 units were completed, and there were 1,200 units of ending work in process. How many units were started into production? A) 1,200. B) 14,800. C) 17,200. D) 16,000. 65. A process Cess with no beginning work in process, completed and transferred out 35.000 is during a period and had 14,000 units in the ending work in process that were 50% complete. How much is equivalent units of production for the period for conversion costs? A) 28,000 equivalent units. B) 56,000 equivalent units. C) 42,000 equivalent units. D) 49,000 equivalent units. 66. One of Stine Company's activity cost pools is machine setups, with estimated overhead of $360,000. Stine produces sparklers (400 setups) and lighters (600 setups). How much of the machine setup cost pool should be assigned to sparklers? A) S144,000 B) $216,000 C) $360,000 D) $180,000 67. Barnes and Miller Manufacturing is trying to determine the equivalent units for conversion costs with 10,000 units of ending work in process at 80% completion and 32,000 physical units. There are no beginning units in the department. Conversion costs occur evenly throughout the entire production period. What are the equivalent units for conversion costs for the current period? A) 40,000 B) 8,000. C) 30,000 D) 42,000. 68. If the Manufacturing Overhead account has a debit balance at the end of a period, it means that A) actual overhead costs were equal to overhead costs applied to jobs. B) no jobs have been completed. C) actual overhead costs were greater than overhead costs applied to jobs. D) actual overhead costs were less than overhead costs applied to jobs. 69. Manufacturing costs that cannot be classified as either direct materials or direct labor are known as A) manufacturing overhead. B) nonmanufacturing costs. C) selling and administrative expenses. D) period costs. 70. Conversion cost per unit equals $6. Total materia on cost per unit equals $6. Total materials cost equal $90,000. Equivalent units for materials are 10,000. How much is the total manufacturing cost per unit A) $12. B) $6. C) $15. D) $9. 71. Advances in computerized systems, technological innovation, global competition, and automation have changed the manufacturing environment drastically by A) decreasing direct labor costs and increasing overhead costs. B) increasing direct labor costs and decreasing overhead costs. C) decreasing direct labor costs and decreasing overhead costs. D) increasing direct labor costs and increasing overhead costs. 72. It is necessary to calculate equivalent units of production in a department because A) some units worked on in the department are not fully complete. B) a physical count of units is impossible. C) the physical units in the department are always 100% complete. D) at times a department may use a job order cost system and then switch to a process cost system 73. At the end of the year, any balance in the Manufacturing Overhead account is generally eliminated by adjusting A) Work In Process Inventory. B) Finished Goods Inventory. C) Raw Materials Inventory. D) Cost of Goods Sold. 74. Which of the following is not used in assigning manufacturing costs to work in process inventory? A) Actual manufacturing overhead B) Time tickets C) Predetermined overhead rate D) Materials requisitions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts