Question: 44. (Worth 2 points. Please show your work or method of calculation) If you were to receive an annuity for the next five years of

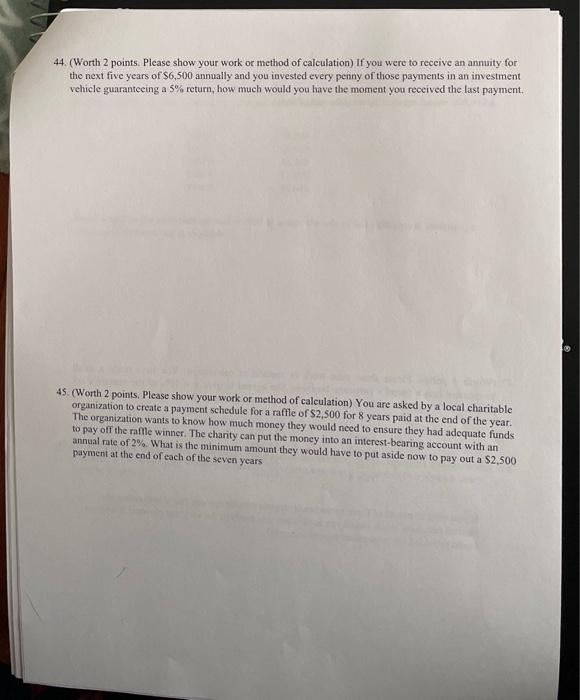

44. (Worth 2 points. Please show your work or method of calculation) If you were to receive an annuity for the next five years of $6,500 annually and you invested every penny of those payments in an investment vehicle guaranteeing a 5% return, how much would you have the moment you received the last payment. 45. (Worth 2 points, Please show your work or method of calculation) You are asked by a local charitable organization to create a payment schedule for a raffle of $2,500 for 8 years paid at the end of the year. The organization wants to know how much money they would need to ensure they had adequate funds to pay off the rafle winner. The charity can put the money into an interest-bearing account with an annual nte of 2%. What is the minimum amount they would have to put aside now to pay out a $2,500 payment at the end of each of the seven years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts