Question: 4-41 Module 4 | Credit Risk Analysis and Interpretation Cambridge Business Publishers TARGET L03 E4-29. Adjusting Financial Information Prior to Credit Analysis ANALYST ADJUSTMENTS 4.2

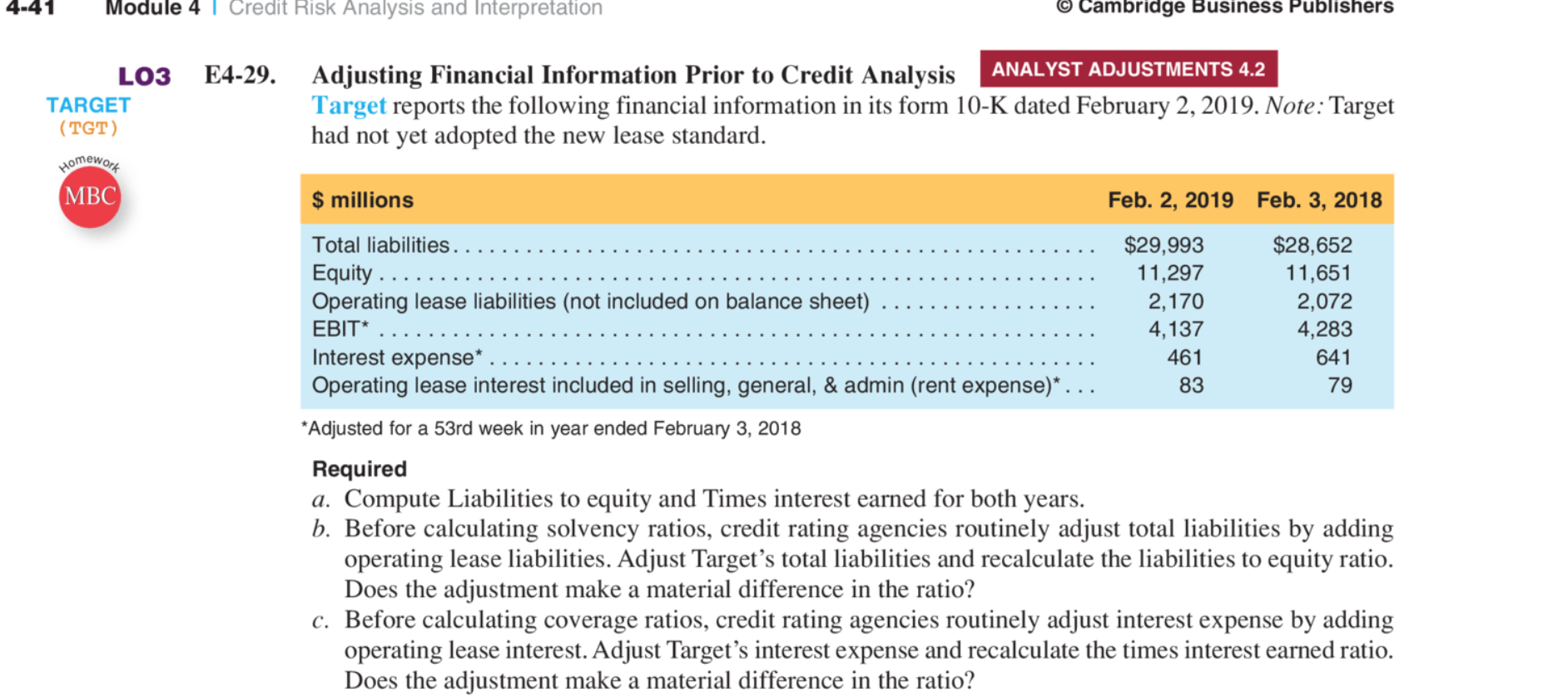

4-41 Module 4 | Credit Risk Analysis and Interpretation Cambridge Business Publishers TARGET L03 E4-29. Adjusting Financial Information Prior to Credit Analysis ANALYST ADJUSTMENTS 4.2 Target reports the following financial information in its form 10-K dated February 2, 2019. Note: Target (TGT) had not yet adopted the new lease standard. Homewort ( $ millions Feb. 2, 2019 Feb. 3, 2018 Total liabilities. $29,993 $28,652 Equity .. 11,297 11,651 Operating lease liabilities (not included on balance sheet) 2,170 2,072 EBIT* .. 4,137 4,283 Interest expense* 461 641 Operating lease interest included in selling, general, & admin (rent expense)*... 83 *Adjusted for a 53rd week in year ended February 3, 2018 Required a. Compute Liabilities to equity and Times interest earned for both years. b. Before calculating solvency ratios, credit rating agencies routinely adjust total liabilities by adding operating lease liabilities. Adjust Targets total liabilities and recalculate the liabilities to equity ratio. Does the adjustment make a material difference in the ratio? c. Before calculating coverage ratios, credit rating agencies routinely adjust interest expense by adding operating lease interest. Adjust Target's interest expense and recalculate the times interest earned ratio. Does the adjustment make a material difference in the ratio? 79

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts