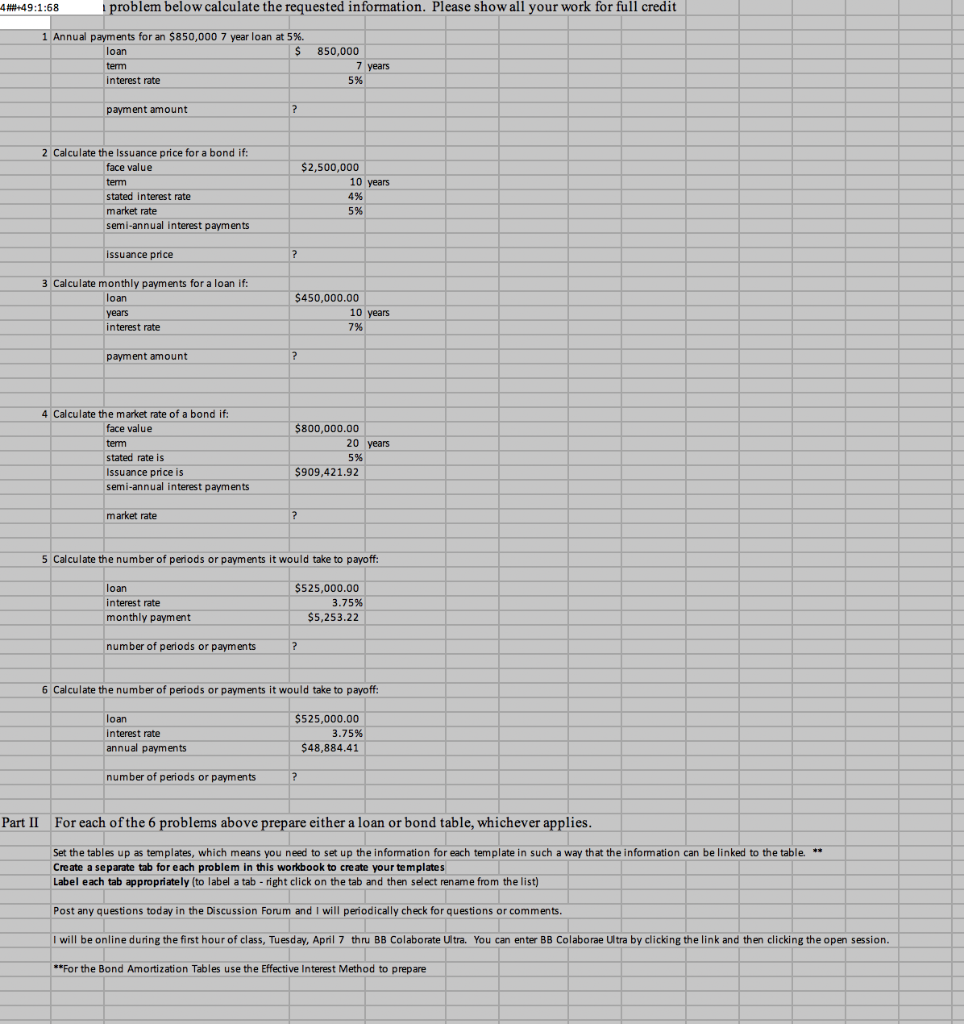

Question: 44#+49:1:58 i problem below calculate the requested information. Please show all your work for full credit 1 Annual payments for an $850,000 7 year loan

44#+49:1:58 i problem below calculate the requested information. Please show all your work for full credit 1 Annual payments for an $850,000 7 year loan at 5%. loan $ term interest rate 850,000 7 years 5% payment amount $2,500,000 10 years 2 Calculate the Issuance price for a bond if: face value term stated interest rate market rate semi-annual interest payments 4% 5% Issuance price 3 Calculate monthly payments for a loan if: loan years interest rate $450,000.00 10 years 7% payment amount 4 Calculate the market rate of a bond if: face value term stated rate is Issuance price is semi-annual interest payments $800,000.00 20 years 5% $909,421.92 market rate 5 Calculate the number of periods or payments it would take to payoff: loan interest rate monthly payment $525,000.00 3.75% $5,253.22 number of periods or payments 6 Calculate the number of periods or payments it would take to payoff: loan interest rate annual payments $525,000.00 3.75% $48,884.41 number of periods or payments Part II For each of the 6 problems above prepare either a loan or bond table, whichever applies. Set the tables up as templates, which means you need to set up the information for each template in such a way that the information can be linked to the table. ** Create a separate tab for each problem in this workbook to create your templates Label each tab appropriately (to label a tab - right click on the tab and then select rename from the list) Post any questions today in the Discussion Forum and I will periodically check for questions or comments. I will be online during the first hour of class, Tuesday, April 7 thru BB Colaborate Ultra. You can enter BB Colaborae Ultra by clicking the link and then clicking the open session. **For the Bond Amortization Tables use the Effective Interest Method to prepare

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts