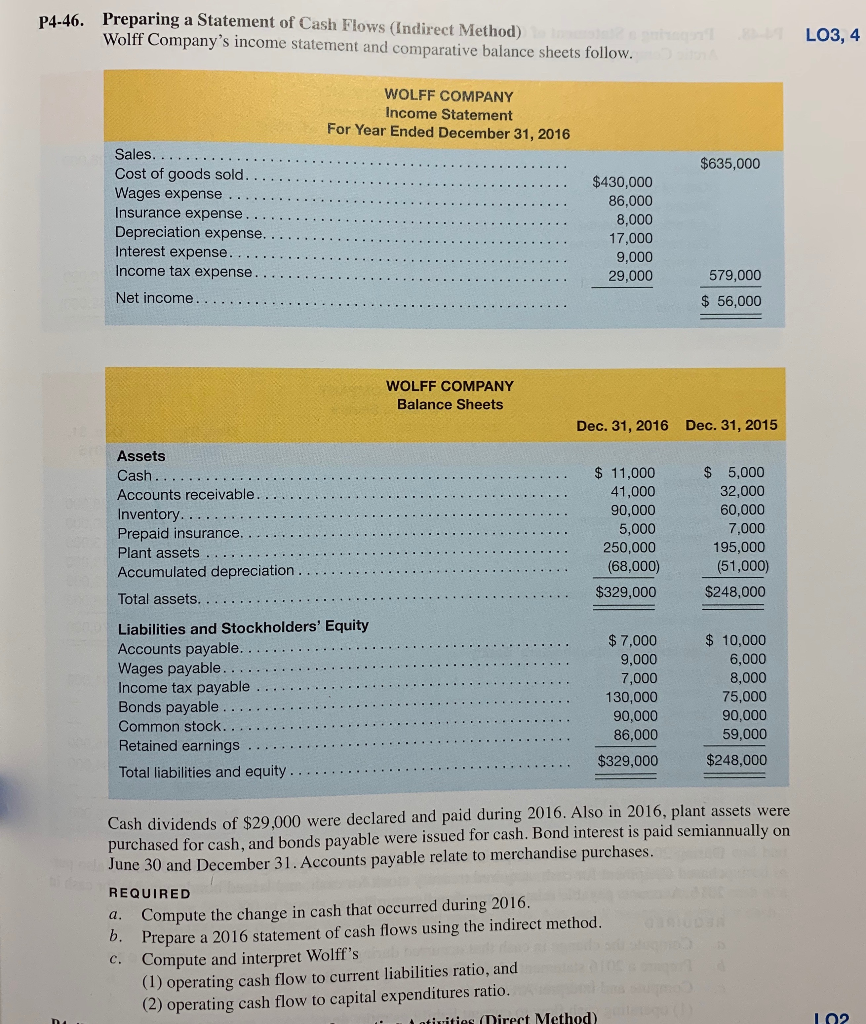

Question: 4.46. Preparing a Statement of Cash Flows (Indirect Method) Wolff Company's income statement and comparative balance sheets follow LO3, 4 WOLFF COMPANY Income Statement For

4.46. Preparing a Statement of Cash Flows (Indirect Method) Wolff Company's income statement and comparative balance sheets follow LO3, 4 WOLFF COMPANY Income Statement For Year Ended December 31, 2016 $635,000 $430,000 86,000 8,000 17,000 9,000 29,000 Wages expense 579,000 Net income 56,000 WOLFF COMPANY Balance Sheets Dec. 31, 2016 Dec. 31, 2015 Assets Accounts receivable Prepaid insurance. $11,000 41,000 90,000 5,000 250,000 (68,000) 5,000 32,000 60,000 7,000 195,000 (51,000) $248,000 Plant assets ....$329,000 Liabilities and Stockholders' Equity Accounts payable.... Wages payable. Income tax payable.. Bonds payable $7,000 9,000 7,000 130,000 90,000 86,000 $10,000 6,000 8,000 75,000 90,000 59,000 . Retained earnings Total liabilities and equity $329,000 $248,000 Cash dividends of $29,000 were declared and paid during 2016. Also in 2016, plant assets w purchased for cash, and bonds payable were issued for cash. Bond interest is paid semiannually on June 30 and December 31. Accounts payable relate to merchandise purchases. REQUIRED ere Compute the change in cash that occurred during 2016. Prepare a 2016 statement of cash flows using the indirect method Compute and interpret Wolff's (1) operating cash flow to current liabilities ratio, and (2) operating cash flow to capital expenditures ratio a. b. c. atiuities Direct Method) L 02

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts