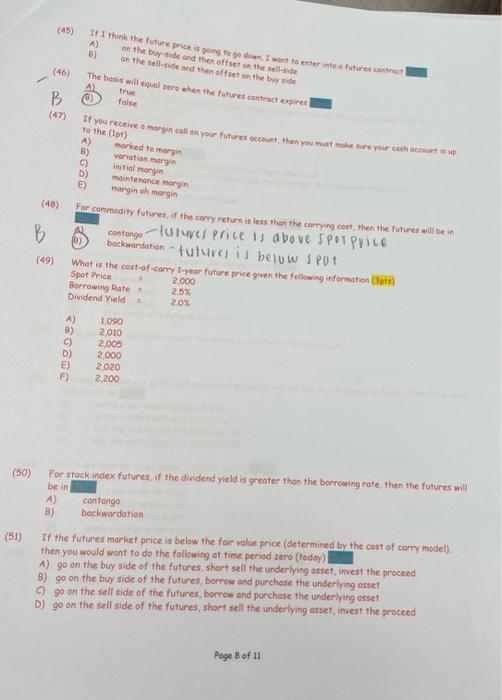

Question: (45) (46) true B (47) It I think the future price is going to go down, I want to enter into a futures contract A)

(45) (46) true B (47) It I think the future price is going to go down, I want to enter into a futures contract A) on the buy-side and then offset on the sells.de B) on the sell-side and then offset on the bude The basis will equal zero when the futures contract expires A false If you receive a margin call on your futures account, then you must make sure your cash account is up to the Cipt) A) morked to margin 9) voration margin C) initial margin b) maintenance margin E) morgin oh morge (48) B For commodity futures, if the carry return is less than the carrying cost, then the futures will be in contonge -turuve price is above Spot Price hackwardation - future is beluw Spot What is the cost-of-carry tyror future price given the following information Capti Spot Price 2 000 Borrowing Rate 25% Dividend Yield 20% (49) A) B) OOOO 1.090 2010 2005 2000 2020 D) 2,200 (50) (51) For stock index futures, if the dividend yield is greater than the borrowing rate, then the futures will be in A) confango B) backwardotion If the futures market price is below the fair value price (determined by the cost of curry model) then you would want to do the following at time period zero (today) A) go on the buy side of the futures short sell the underlying asset invest the proceed B) go on the buy side of the futures, borrow and purchase the underlying asset go on the sell side of the futures, borrow and purchase the underlying asset D) go on the sell side of the futures, short sell the underlying asset, invest the proceed Page 3 of 11 (45) (46) B A ) IF I think the future price is going to go down I want to enter into for contract A) on the buy-side and then offset on the sellide B) of the sell side and then offset on the buye The boss will equire when the futures contract expires th false If you receive a margin call on your futures account then you must make sure your chacutis to the (pt) A) maradto margin B) vorition margir intolog D) mote morgen E) margin of marge (48) B For.commodity futures of the corry return at less than the carrying cort, then the futures will be in contengo-luruves price is above spor price bochwerderion - tutures is below spot What is the cost-of-carry 1 year future price given the following information Cots) Spot Price 2000 Borrowing Rate 257 Dividend Yield 20% (49) A) B) D) E F) 1.090 2010 2005 2.000 2020 2200 (50) For stock index futures, if the dividend yield is greater than the borrowing note, then the future will ben A) contongo 8) backwardation (51) If the futures market price is below the fair value price (determined by the cost of corny model) Then you would want to do the following at time period zero (today) A) go on the buy side of the futures, short sell the underlying asset invest the proceed B) go on the buy side of the futures, borrow and purchase the underlying osset C) go on the sell side of the futures, borrow and purchase the underlying asset D) go on the sell side of the futures, short sell the underlying asset, invest the proceed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts