Question: 45. After a start-up entity has exhausted their ability to obtain funds from friends and relatives they often turn to a network of investors that

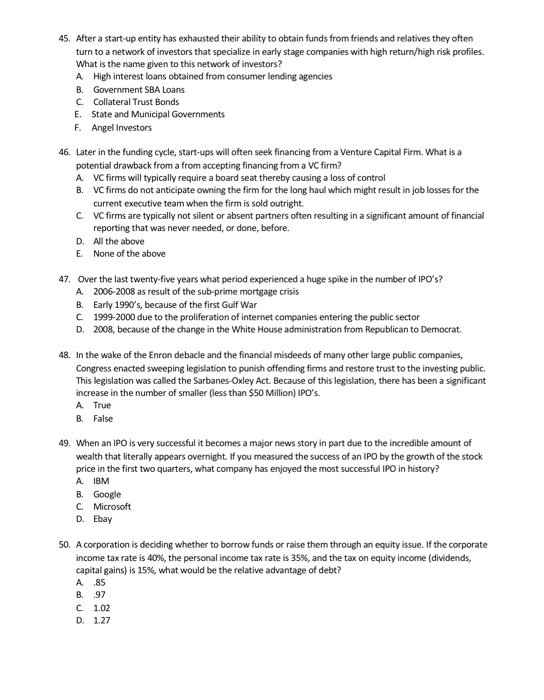

45. After a start-up entity has exhausted their ability to obtain funds from friends and relatives they often turn to a network of investors that specialize in early stage companies with high return/high risk profiles. What is the name given to this network of investors? A High interest loans obtained from consumer lending agencies B. Government SBA Loans C. Collateral Trust Bonds E. State and Municipal Governments F. Angel Investors 46 Later in the funding cycle, start-ups will often seek financing from a Venture Capital Firm. What is a potential drawback from a from accepting financing from a VC firmi? A. VC firms will typically require a board seat thereby causing a loss of control B. VC firms do not anticipate owning the firm for the long haul which might result in job losses for the current executive team when the firm is sold outright. C. VC firms are typically not silent or absent partners often resulting in a significant amount of financial D. E. reporting that was never needed, or done, before. All the above None of the above 47. Over the last twenty-five years what period experienced a huge spike in the number of IPO's? A B. C. D- 2006-2008 as result of the sub-prime mortgage crisis Early 1990's, because of the first Gulf War 1999-2000 due to the proliferation of internet companies entering the public sector 2008, because of the change in the White House administration from Republican to Democrat. 48. In the wake of the Enron debacle and the financial misdeeds of many other large public companies, Congress enacted sweeping legislation to punish offending firms and restore trust to the investing public. This legislation was called the Sarbanes-Oxley Act. Because of this legislation, there has been a significant increase in the number of smaller (less than $50 Million) IPO's. A True B. False 49. When an IPO is very successful it becomes a major news story in part due to the incredible amount of wealth that literally appears overnight. If you measured the success of an IPO by the growth of the stodk price in the first two quarters, what company has enjoyed the most successful IPO in history? A IBM B. Google C. Microsoft D. Ebay 50. A corporation is deciding whether to borrow funds or raise them through an equity issue. If the corporate income tax rate is 40%, the personal income tax rate is 35%, and the tax on equity income (dividends, capital gains) is 15%, what would be the relative advantage of debt? A .85 B. .97 C. 1.02 D. 1.27

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts