Question: 4-5 Chapter 7 Homework Saved 4 Bond X is a premium bond making semiannual payments. The bond pays a coupon rate of 11 percent, has

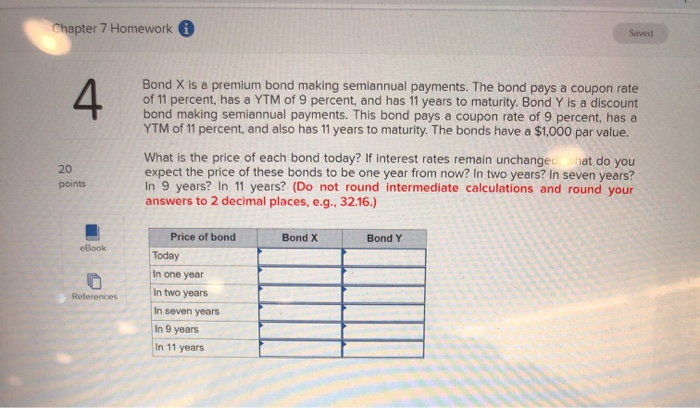

Chapter 7 Homework Saved 4 Bond X is a premium bond making semiannual payments. The bond pays a coupon rate of 11 percent, has a YTM of 9 percent, and has 11 years to maturity. Bond Y is a discount bond making semiannual payments. This bond pays a coupon rate of 9 percent, has a YTM of 11 percent, and also has 11 years to maturity. The bonds have a $1,000 par value. What is the price of each bond today? If interest rates remain unchanged hat do you expect the price of these bonds to be one year from now? In two years? In seven years? In 9 years? In 11 years? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g. 32.16.) 20 points Bond X Bond Y eBook Price of bond Today In one year In two years In seven years In 9 years In 11 years References

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts