Question: 45. If the auditor changes a number on a client's financial statements, this would most violate A. Due Care B. Competence C. Independence D. All

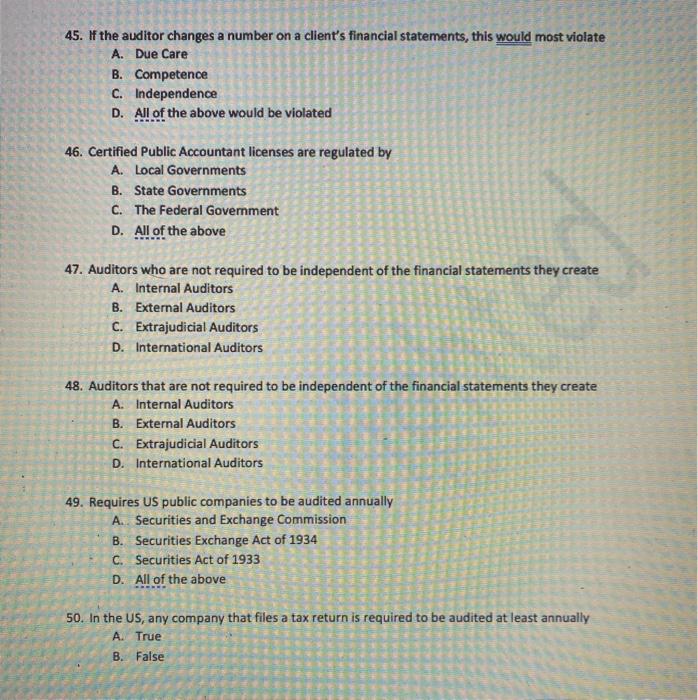

45. If the auditor changes a number on a client's financial statements, this would most violate A. Due Care B. Competence C. Independence D. All of the above would be violated 46. Certified Public Accountant licenses are regulated by A. Local Governments B. State Governments C. The Federal Government D. All of the above 47. Auditors who are not required to be independent of the financial statements they create A. Internal Auditors B. External Auditors C. Extrajudicial Auditors D. International Auditors 48. Auditors that are not required to be independent of the financial statements they create A. Internal Auditors B. External Auditors C. Extrajudicial Auditors D. International Auditors 49. Requires US public companies to be audited annually A. Securities and Exchange Commission B. Securities Exchange Act of 1934 C. Securities Act of 1933 D. All of the above 50. In the US, any company that files a tax return is required to be audited at least annually A. True B. False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts