Question: 4,5,6 please help me out i will thumb up QUESTION 4 White balloon mortgage loan payments are typically based on a 30 year amortization schedule,

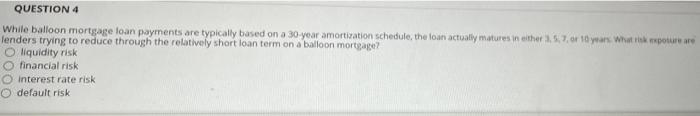

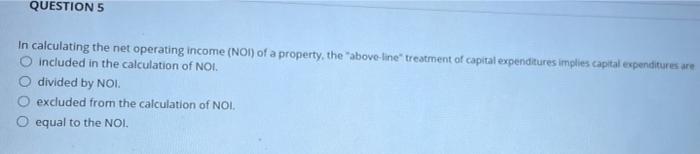

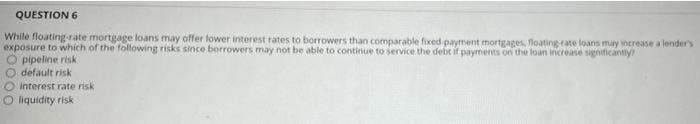

QUESTION 4 White balloon mortgage loan payments are typically based on a 30 year amortization schedule, the loan actually matures in either...or 10 years. What is expoure are lenders trying to reduce through the relatively short loan term on a balloon mortgage? O liquidity risk financial risk interest rate risk O default risk QUESTION 5 In calculating the net operating income (NOI) of a property, the above-line treatment of capital expenditures implies capital expenditures are O included in the calculation of NOI. O divided by NOI excluded from the calculation of NOI equal to the NOL QUESTION 6 While floating rate mortgage loans may offer lower interest rates to borrowers than comparable fixed payment mortgages floating rate loans may increase alender's exposure to which of the following risks since borrowers may not be able to continue to service the debt if payments on the loan increase significantly O pipeline risk default risk Interest rate risk liquidity risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts