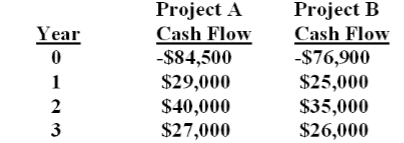

Question: 46. You are analyzing two mutually exclusive projects and have developed the following information. What is the incremental IRR? A. 11.11% B. 13.01% C. 14.91%

46. You are analyzing two mutually exclusive projects and have developed the following information. What is the incremental IRR? A. 11.11% B. 13.01% C. 14.91% D. 16.75% E. 17.90%

Chapter 9 - Net Present Value and Other Investment Rules 5-12 47. Based on the profitability index of _____ for this project, you should _____ the project. A. .97; accept B. 1.05; accept C. 1.18; accept D. .97; reject E. 1.05; reject 48. Based on the internal rate of return of _____ for this project, you should _____ the project. A. 8.95%; accept B. 10.75%; accept C. 8.44%; reject D. 9.67%; reject E. 10.33%; reject 49. Based on the net present value of _____ for this project, you should _____ the project. A. -$2,021.28; reject B. -$406.19; reject C. $7,978.72; accept D. $9,836.74; accept E. $12,684.23; accept No excel because I need to see the formulas to understand

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts