Question: 476 CHAPTER 14 7. An exchange gain on a long-term loan of a U.S. parent company to its British subsidiary whose functional currency is the

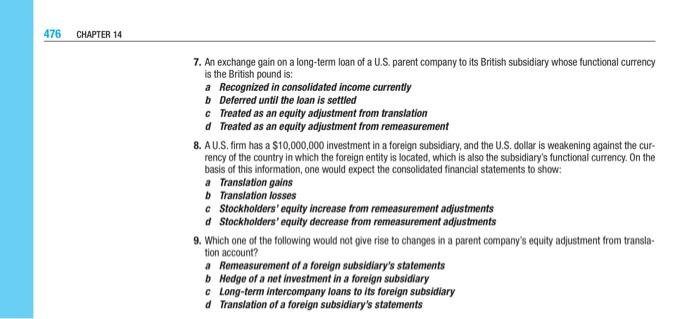

476 CHAPTER 14 7. An exchange gain on a long-term loan of a U.S. parent company to its British subsidiary whose functional currency is the British pound is: a Recognized in consolidated income currently Deferred until the loan is settled c Treated as an equity adjustment from translation d Treated as an equity adjustment from remeasurement 8. AU.S.fim has a $10,000,000 investment in a foreign subsidiary, and the U.S. dollar is weakening against the cur- rency of the country in which the foreign entity is located, which is also the subsidiary's functional currency. On the basis of this information, one would expect the consolidated financial statements to show: a Translation gains Translation losses c Stockholders' equity increase from remeasurement adjustments d Stockholders' equity decrease from remeasurement adjustments 9. Which one of the following would not give rise to changes in a parent company's equity adjustment from transla- tion account? a Remeasurement of a foreign subsidiary's statements bMedge of a net investment in a foreign subsidiary c Long-term Intercompany loans to its foreign subsidiary Translation of a foreign subsidiary's statements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts