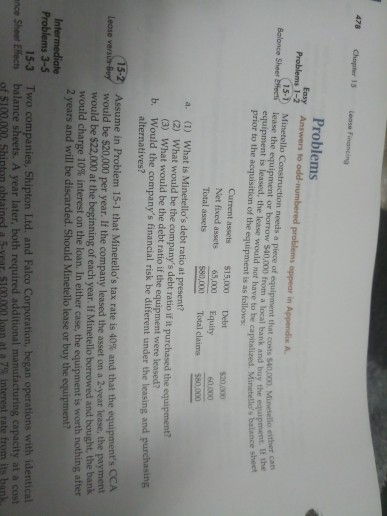

Question: 478 Chapter 15 Case Financing Problems 1-2 15-1 Balance Sheer Becs Problems Answers to odd-numbered problems appear in Appendix A Minetello Construction needs a piece

478 Chapter 15 Case Financing Problems 1-2 15-1 Balance Sheer Becs Problems Answers to odd-numbered problems appear in Appendix A Minetello Construction needs a piece of equipment that costs $40.000. Mine lease the equipment or borrow 500.000 from a local bank and buy the equipment is leased, the lease would not have to be capitalized Mincess prior to the acquisition of the equipment is as follows the sheet Current assets $15.000 Debt $20,000 Net fixed assets 65.000 Equity 60,000 Total assets $80,000 Total claims 580,000 a. (1) What is Minetello's debt ratio at present? (2) What would be the company's debt ratio if it purchased the equipment (3) What would be the debt ratio if the equipment were lessed? b. Would the company's financial risk be different under the leasing and purchasing alternatives? 15-2 Assume in Problem 15.1 that Minetello's tax rate is 40% and that the equipments would be $20,000 per year. If the company leased the asset on a 2-year lease, the payment would be $22,000 at the beginning of each year. If Minetello borrowed and bought, the bank would charge 10% interest on the loan. In either case, the equipment is worth nothing an 2 years and will be discarded. Should Minetello lease or buy the equipment Intermediate Problems 3-5 15-3 ance Sheet Effects Two companies, Shipton Ltd. and Falco Corporation, began operations with identical balance sheets. A year later, both required additional manufacturing capacity at a cost of S100.000. Shipten obtained a 5-year $100.000 loan at a 7% interest rate from its bank

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts