Question: 4.8 When dynamically hedging an option position to make it delta-neutral, the trader needs to trade a. The underlying security b. Another option on the

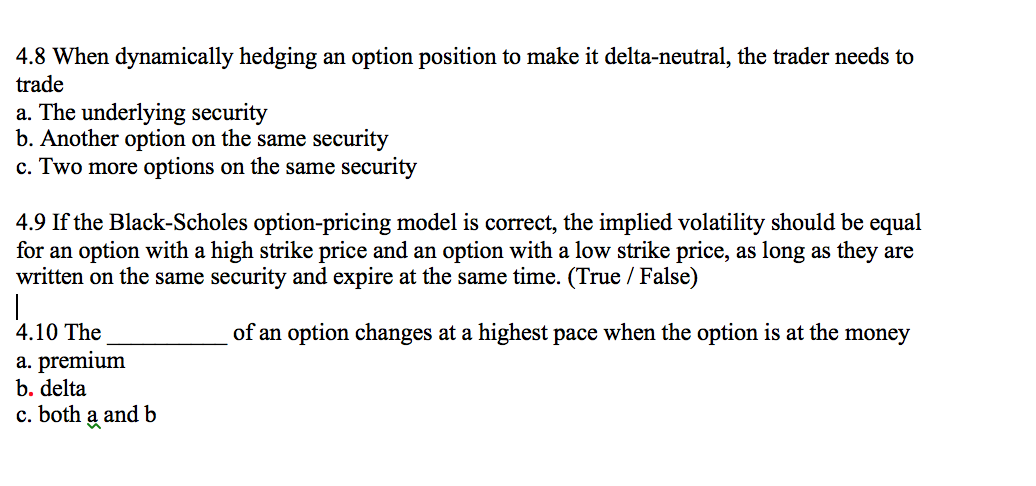

4.8 When dynamically hedging an option position to make it delta-neutral, the trader needs to trade a. The underlying security b. Another option on the same security c. Two more options on the same security 4.9 If the Black-Scholes option-pricing model is correct, the implied volatility should be equal for an option with a high strike price and an option with a low strike price, as long as they are written on the same security and expire at the same time. (True / False) of an option changes at a highest pace when the option is at the money 4.10 The a. premium b. delta c. both a and b

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts