Question: 485 Big Pharma shares $490 per share Additional information: On the sale of the shares, Dr. Roy paid a brokerage commission of $3,100. 1100

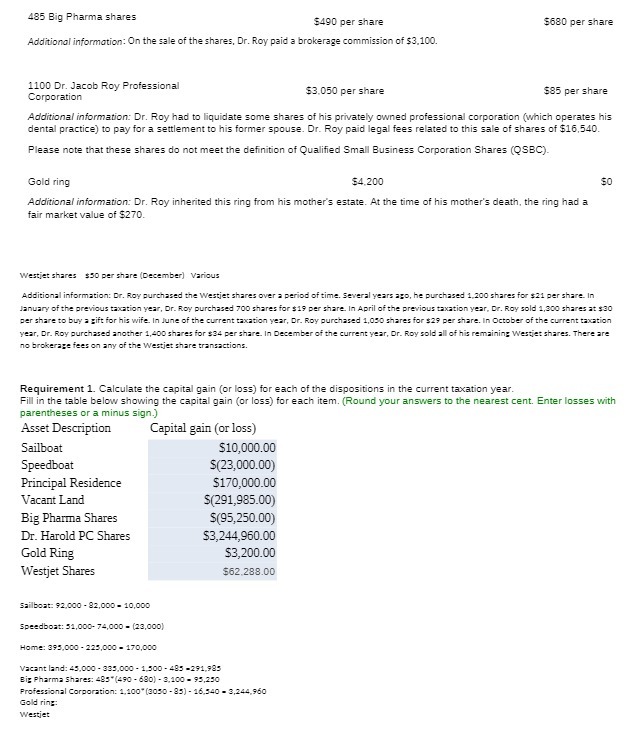

485 Big Pharma shares $490 per share Additional information: On the sale of the shares, Dr. Roy paid a brokerage commission of $3,100. 1100 Dr. Jacob Roy Professional Corporation $3.050 per share $85 per share Additional information: Dr. Roy had to liquidate some shares of his privately owned professional corporation (which operates his dental practice) to pay for a settlement to his former spouse. Dr. Roy paid legal fees related to this sale of shares of $16,540. Please note that these shares do not meet the definition of Qualified Small Business Corporation Shares (QSBC). $4.200 Gold ring Additional information: Dr. Roy inherited this ring from his mother's estate. At the time of his mother's death, the ring had a fair market value of $270. Westjet shares $50 per share (December) Various Additional information: Dr. Roy purchased the Westjet shares over a period of time. Several years ago, he purchased 1,200 shares for $21 per share. In January of the previous taxation year, Dr. Roy purchased 700 shares for $19 per share. In April of the previous taxation year, Dr. Roy sold 1,300 shares at $30 per share to buy a gift for his wife. In June of the current taxation year, Dr. Roy purchased 1,050 shares for $29 per share. In October of the current taxation year, Dr. Roy purchased another 1,400 shares for $34 per share. In December of the current year, Dr. Roy sold all of his remaining Westjet shares. There are no brokerage fees on any of the Westjet share transactions. Sailboat Speedboat Principal Residence Vacant Land Requirement 1. Calculate the capital gain (or loss) for each of the dispositions in the current taxation year. Fill in the table below showing the capital gain (or loss) for each item. (Round your answers to the nearest cent. Enter losses with parentheses or a minus sign.) Asset Description Big Pharma Shares Dr. Harold PC Shares Gold Ring Westjet Shares Capital gain (or loss) $680 per share Sailboat: 92,000 -82,000 10,000 Speedboat: 51,000- 74,000 (23,000) $10,000.00 $(23,000.00) $170,000.00 $(291,985.00) $(95,250.00) $3,244,960.00 $3,200.00 $62,288.00 $0 Home: 395,000-225,000 170,000 Vacant land: 45,000-335,000-1,500-485-291,985 Big Pharma Shares: 485 (490-680) -3,100 - 95,250 Professional Corporation: 1,100 (3050-85)-16,540 - 3,244,960 Gold ring: Westjet

Step by Step Solution

There are 3 Steps involved in it

1 Calculate the capital gain or loss for each disposition Asset Description Capital gain or ... View full answer

Get step-by-step solutions from verified subject matter experts