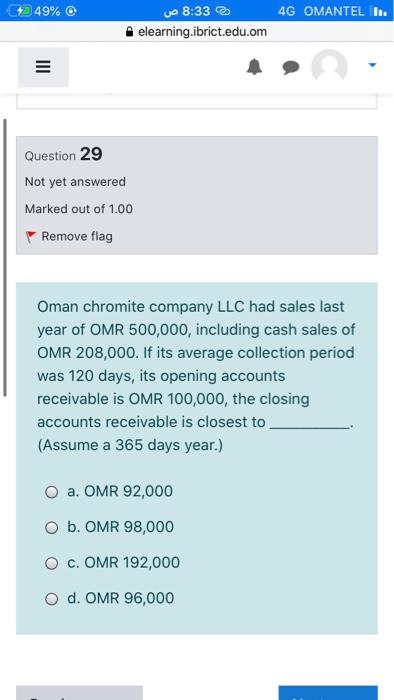

Question: 49% 8:33 4G OMANTEL I. elearning.ibrict.edu.om III Question 29 Not yet answered Marked out of 1.00 Remove flag Oman chromite company LLC had sales last

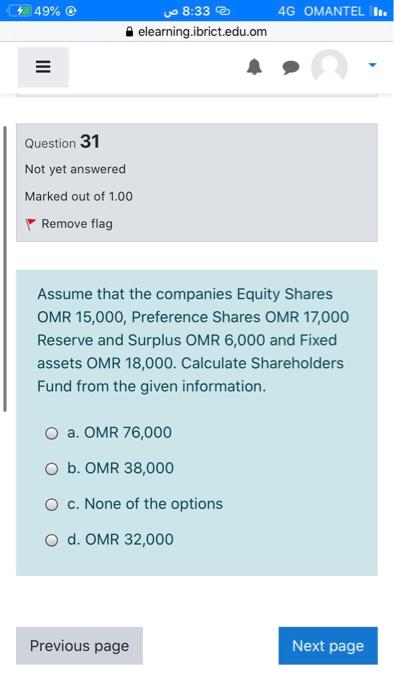

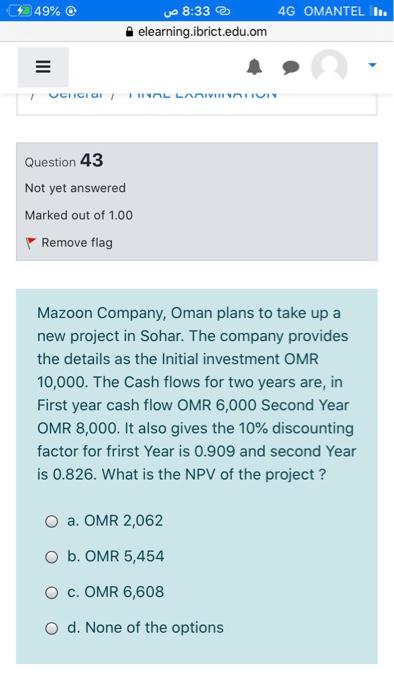

49% 8:33 4G OMANTEL I. elearning.ibrict.edu.om III Question 29 Not yet answered Marked out of 1.00 Remove flag Oman chromite company LLC had sales last year of OMR 500,000, including cash sales of OMR 208,000. If its average collection period was 120 days, its opening accounts receivable is OMR 100,000, the closing accounts receivable is closest to (Assume a 365 days year.) O a. OMR 92,000 O b. OMR 98,000 O c. OMR 192,000 O d. OMR 96,000 49% 8:33 4G OMANTEL I. v elearning.ibrict.edu.om Question 31 Not yet answered Marked out of 1.00 Remove flag Assume that the companies Equity Shares OMR 15,000, Preference Shares OMR 17,000 Reserve and Surplus OMR 6,000 and Fixed assets OMR 18,000. Calculate Shareholders Fund from the given information. O a. OMR 76,000 b. OMR 38,000 c. None of the options O d. OMR 32,000 Previous page Next page 49% 8:33 4G OMANTEL 1. elearning.ibrict.edu.om VCHICIO, FIRAL LANVIN HUN Question 43 Not yet answered Marked out of 1.00 Remove flag Mazoon Company, Oman plans to take up a new project in Sohar. The company provides the details as the initial investment OMR 10,000. The Cash flows for two years are, in First year cash flow OMR6,000 Second Year OMR 8,000. It also gives the 10% discounting factor for frirst Year is 0.909 and second Year is 0.826. What is the NPV of the project ? O a OMR 2,062 O b. OMR 5,454 O c. OMR 6,608 O d. None of the options

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts