Question: 49. Bob is single, age 35, with a dependent child living with him. He has AGI of $415,850 for 2019. Included in the AGI, he

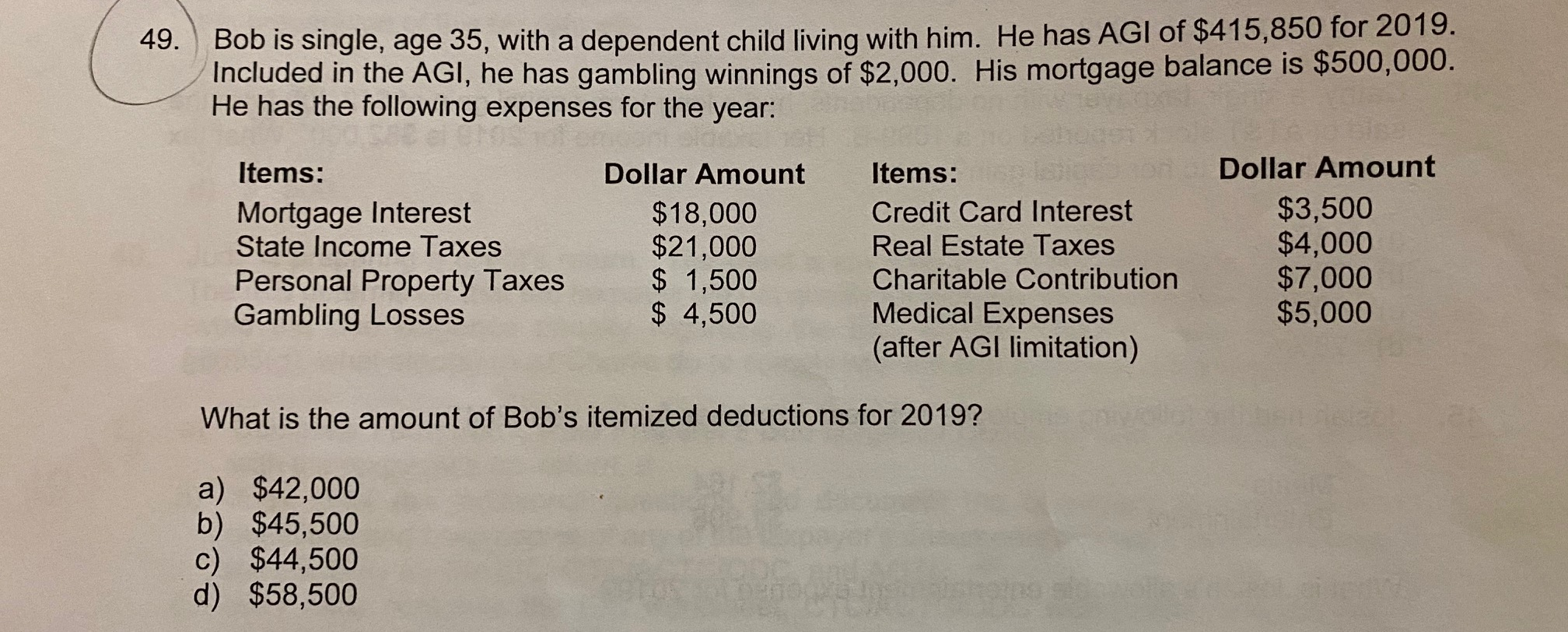

49. Bob is single, age 35, with a dependent child living with him. He has AGI of $415,850 for 2019. Included in the AGI, he has gambling winnings of $2.000. His mortgage balance is $500,000. He has the following expenses for the year: Items: Mortgage Interest State Income Taxes Personal Property Taxes Gambling Losses Dollar Amount $18,000 $21,000 $ 1,500 $ 4,500 Items: Credit Card Interest Real Estate Taxes Charitable Contribution Medical Expenses (after AGI limitation) Dollar Amount $3,500 $4,000 $7,000 $5,000 What is the amount of Bob's itemized deductions for 2019? a) $42,000 b) $45,500 c) $44,500 d) $58,500

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock