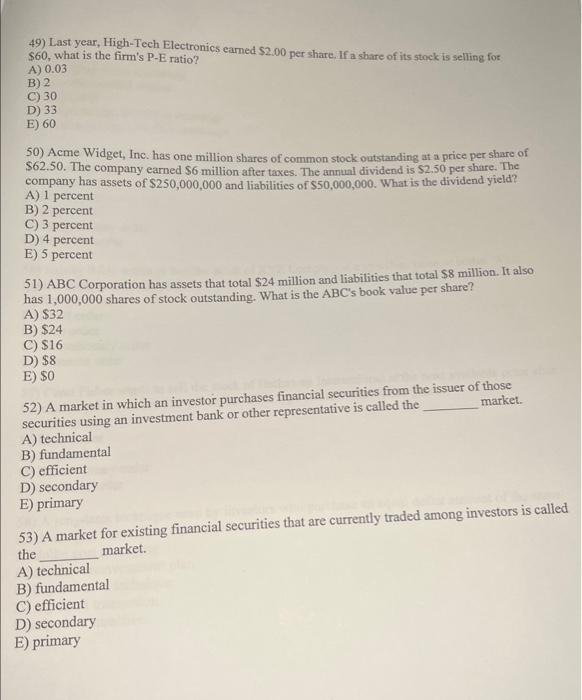

Question: 49) Last year, High-Tech Electronics earned $2.00 per share. If a share of its stack is selling for $60, what is the firm's P-E ratio?

49) Last year, High-Tech Electronics earned $2.00 per share. If a share of its stack is selling for $60, what is the firm's P-E ratio? A) 0.03 B) 2 C) 30 D) 33 E) 60 50) Acme Widget, Inc. has one million shares of common stock outstanding at a price per share of $62.50. The company earned $6 million after taxes. The annual dividend is $2.50 per share. The company has assets of $250,000,000 and liabilities of $50,000,000. What is the dividend yield? A) 1 percent B) 2 percent C) 3 percent D) 4 percent E) 5 percent 51) ABC Corporation has assets that total $24 million and liabilities that total $8 million. It also has 1,000,000 shares of stock outstanding. What is the ABC s book value per share? A) $32 B) $24 C) $16 D) $8 E) $0 52) A market in which an investor purchases financial securities from the issuer of those securities using an investment bank or other representative is called the market. A) technical B) fundamental C) efficient D) secondary E) primary 53) A market for existing financial securities that are currently traded among investors is called the market. A) technical B) fundamental C) efficient D) secondary E) primary

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts