Question: 4a. The replacement ratio method Select one: a. requires the consideration of post-retirement inflation b. Requires an estimation of amount needed to meet future expenses

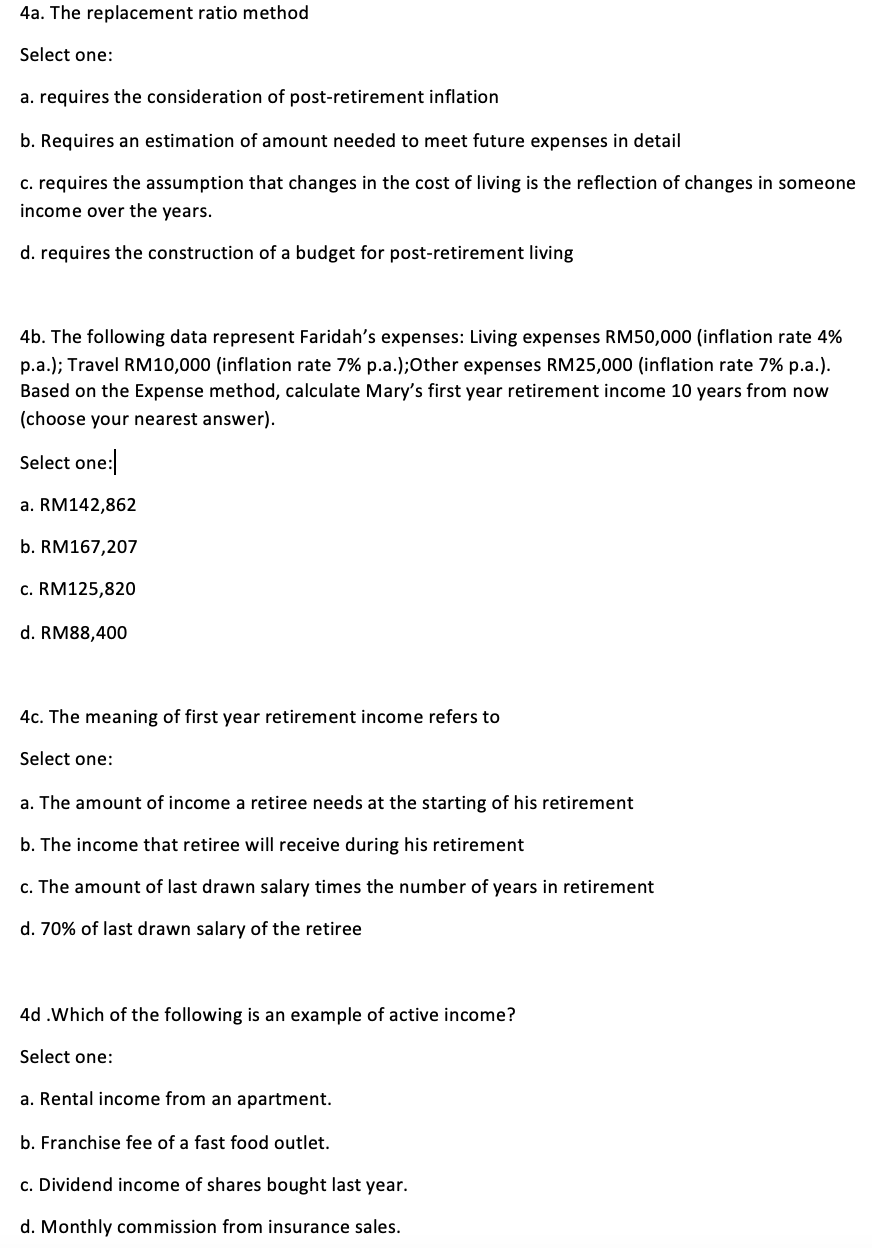

4a. The replacement ratio method Select one: a. requires the consideration of post-retirement inflation b. Requires an estimation of amount needed to meet future expenses in detail c. requires the assumption that changes in the cost of living is the reflection of changes in someone income over the years. d. requires the construction of a budget for post-retirement living 4b. The following data represent Faridah's expenses: Living expenses RM50,000 (inflation rate 4% p.a.); Travel RM10,000 (inflation rate 7% p.a.); Other expenses RM25,000 (inflation rate 7% p.a.). Based on the Expense method, calculate Mary's first year retirement income 10 years from now (choose your nearest answer). Select one: a. RM142,862 b. RM167,207 c. RM125,820 d. RM88,400 4c. The meaning of first year retirement income refers to Select one: a. The amount of income a retiree needs at the starting of his retirement b. The income that retiree will receive during his retirement c. The amount of last drawn salary times the number of years in retirement d. 70% of last drawn salary of the retiree 4d. Which of the following is an example of active income? Select one: a. Rental income from an apartment. b. Franchise fee of a fast food outlet. c. Dividend income of shares bought last year. d. Monthly commission from insurance sales. 4a. The replacement ratio method Select one: a. requires the consideration of post-retirement inflation b. Requires an estimation of amount needed to meet future expenses in detail c. requires the assumption that changes in the cost of living is the reflection of changes in someone income over the years. d. requires the construction of a budget for post-retirement living 4b. The following data represent Faridah's expenses: Living expenses RM50,000 (inflation rate 4% p.a.); Travel RM10,000 (inflation rate 7% p.a.); Other expenses RM25,000 (inflation rate 7% p.a.). Based on the Expense method, calculate Mary's first year retirement income 10 years from now (choose your nearest answer). Select one: a. RM142,862 b. RM167,207 c. RM125,820 d. RM88,400 4c. The meaning of first year retirement income refers to Select one: a. The amount of income a retiree needs at the starting of his retirement b. The income that retiree will receive during his retirement c. The amount of last drawn salary times the number of years in retirement d. 70% of last drawn salary of the retiree 4d. Which of the following is an example of active income? Select one: a. Rental income from an apartment. b. Franchise fee of a fast food outlet. c. Dividend income of shares bought last year. d. Monthly commission from insurance sales

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts