Question: 4a,b Equipment 19) Cutter Enterprises purchased equipment for $93,000 on January 1,2021. The equipment is expected to have a five-year life and a residual value

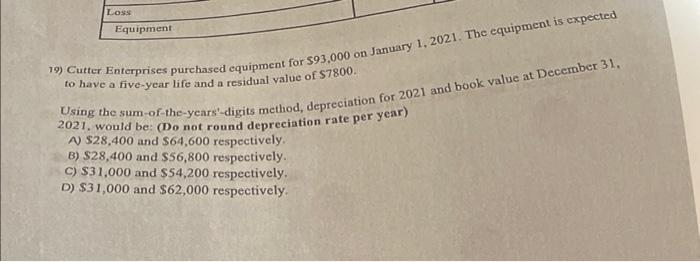

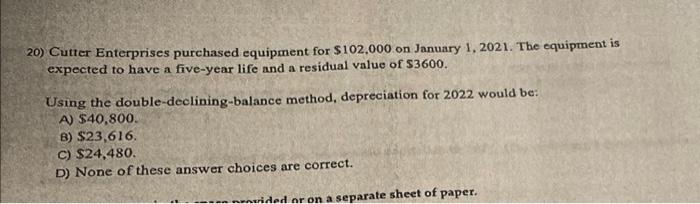

Equipment 19) Cutter Enterprises purchased equipment for $93,000 on January 1,2021. The equipment is expected to have a five-year life and a residual value of $7800. Using the sum-of-the-years'-digits method, depreciation for 2021 and book value at Deceraber 31. 2021. Would be: (Do not round depreciation rate per year) A) $28,400 and $64,600 respectively. B) $28,400 and $56,800 respectively. C) $31,000 and $54,200 respectively. D) $31,000 and $62,000 respectively. 20) Cutter Enterprises purchased equipment for $102,000 on January 1,2021 . The equipment is expected to have a five-year life and a residual value of $3600. Using the double-declining-balance method, depreciation for 2022 would be: A) 540,800 B) 523,616 C) 524,480 D) None of these answer choices are correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts