Question: 4{all 54% e 11:21 PM a Fundamentals of Financial https://books.google.com Add to my library Write review Page 175 of 6 in this book for 175

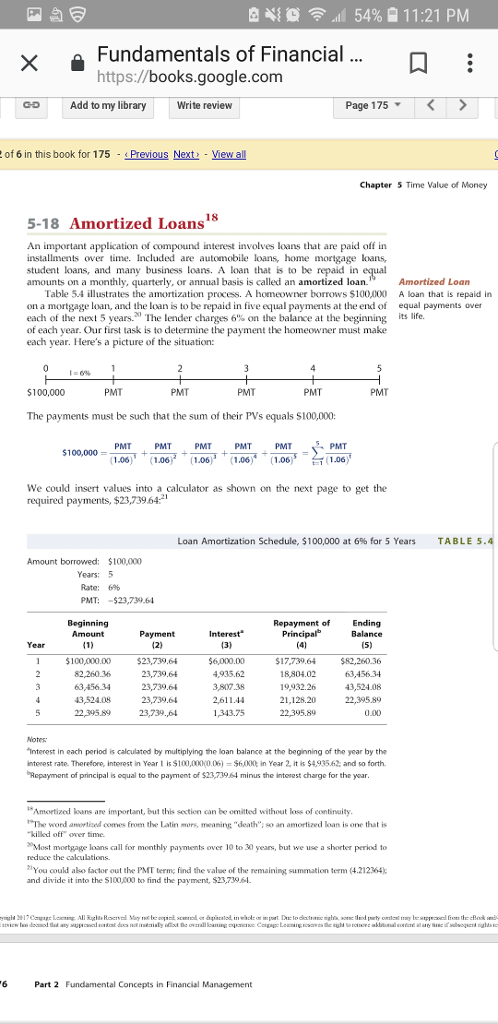

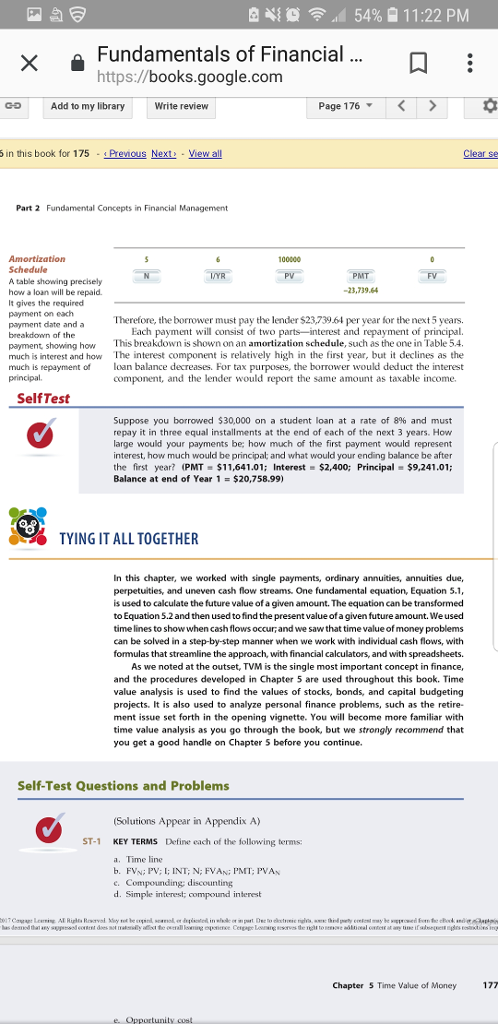

4{all 54% e 11:21 PM a Fundamentals of Financial https://books.google.com Add to my library Write review Page 175 of 6 in this book for 175 Previous Next View all Chapter 5 Time Value of Money 5-18 Amortized Loans1S An important application of compound interest involves loans that are paid off in installments over time. Included are automobile loans, home mortgage loans, student loans, and many business loans. A loan that is to be repaid in equal amounts on a monthly, quarterly, or annual basis is called an amortized loan.Amortized Loan Table 54 illustrates the amortization process. A homeowner borrows $100,000 A loan that is repaid in on a mortgage loan, and the loan is to be repaid in five equal payments at the end of eqal payments over each of the next 5 years. The lender charges 6% on the balance at the beginning its life. of each year. Our first task is to determine the payment the homeowner must make each year. Here's a picture of the situation: $100,000 PMT PMT PMT PMT The payments must be such that the sum of their PVs equals S100,000 PMT PMT PMT PMT PMT PMT 1.06 1.06(1.06 1.00 1.061.00 $100,000 We could insert values into a calculator as shown on the next page to get the required payments, $23,739.64 Loan Amortization Schedule, $100,000 at 6% for 5 Years TABLE 5 Amount borrowed: $100,000 Years: 5 Rate: 6% PMT: $23,73961 BeginningPayment Repayment of Ending 4,935.62 22,0589 23,2964 738 18,804,02 26036 3,807.38 2,611.44 $17.739.64 100,000.00 $23,739.64 23,739.64 23,739.64 23,739.64 82,260.36 63,45634 43,524.08 19932.26 21,128.20 0.00 Notes Interest in each period is calculated by multiplying the loan balance at the beginning of the year by the interest rate. Therefore, intorest in Year 1 is $100,0000.06) $6,000 in Year 2, it s $4,935.62 and so forth. Repayment of principal is equal to the payment of $23,73964 minus the intorest charge for the year sAmortized oans are important, but this section can be omited without loss of continuity The word amovieed comes from the Latin mors, meaning "death"; so an amortized loan is one that is kilkd off ower time. Most mortgage loans call for monthly payments over 10 to 30 yeans, but we use a shorter period to reduce the calculations. You could also factor out the PMT term; find the value of the remaining summation term (4.212364) and divide it into the $100,000 to find the payment, $23,73961 Part 2 Fundamental Concepts in Financial Management

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts