Question: 4.b. How can we understand and evaluate the cash position of a company? 4.c. Why Working capital management is important? Explain briefly. 5. The capital

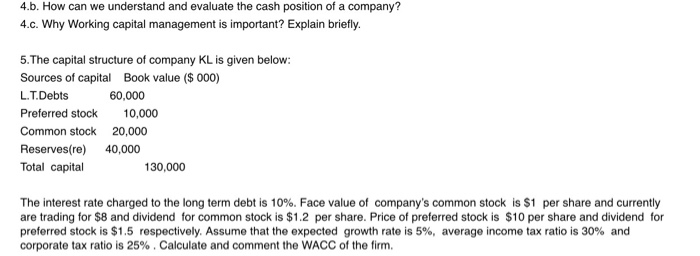

4.b. How can we understand and evaluate the cash position of a company? 4.c. Why Working capital management is important? Explain briefly. 5. The capital structure of company KL is given below: Sources of capital Book value ($ 000) L.T.Debts 60,000 Preferred stock 10,000 Common stock 20,000 Reserves(re) 40,000 Total capital 130,000 The interest rate charged to the long term debt is 10%. Face value of company's common stock is $1 per share and currently are trading for $8 and dividend for common stock is $1.2 per share. Price of preferred stock is $10 per share and dividend for preferred stock is $1.5 respectively. Assume that the expected growth rate is 5%, average income tax ratio is 30% and corporate tax ratio is 25%. Calculate and comment the WACC of the firm

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts