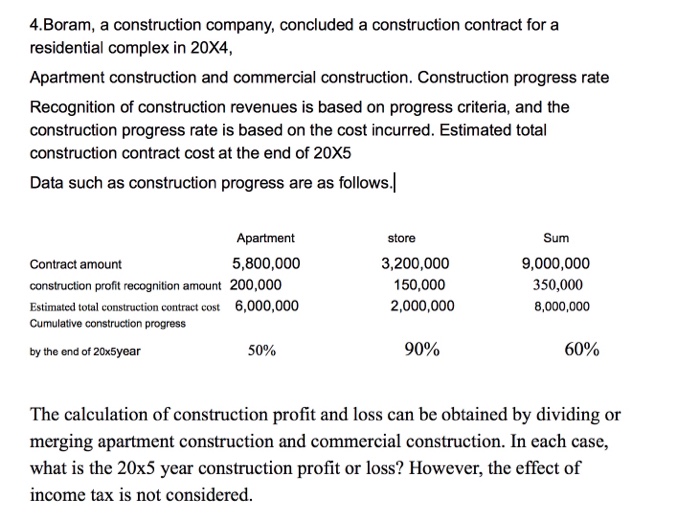

Question: 4.Boram, a construction company, concluded a construction contract for a residential complex in 20X4, Apartment construction and commercial construction. Construction progress rate Recognition of construction

4.Boram, a construction company, concluded a construction contract for a residential complex in 20X4, Apartment construction and commercial construction. Construction progress rate Recognition of construction revenues is based on progress criteria, and the construction progress rate is based on the cost incurred. Estimated total construction contract cost at the end of 20X5 Data such as construction progress are as follows. Apartment 5,800,000 200,000 6,000,000 Sum 9,000,000 350,000 8,000,000 store 3,200,000 Contract amount construction profit recognition amount Estimated total construction contract cost Cumulative construction progress 50,000 2,000,000 by the end of 20x5year 50% 90% 60% The calculation of construction profit and loscan be obtained by dividing or merging apartment construction and commercial construction. In each case what is the 20x5 year construction profit or loss? However, the effect of income tax is not considered

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts