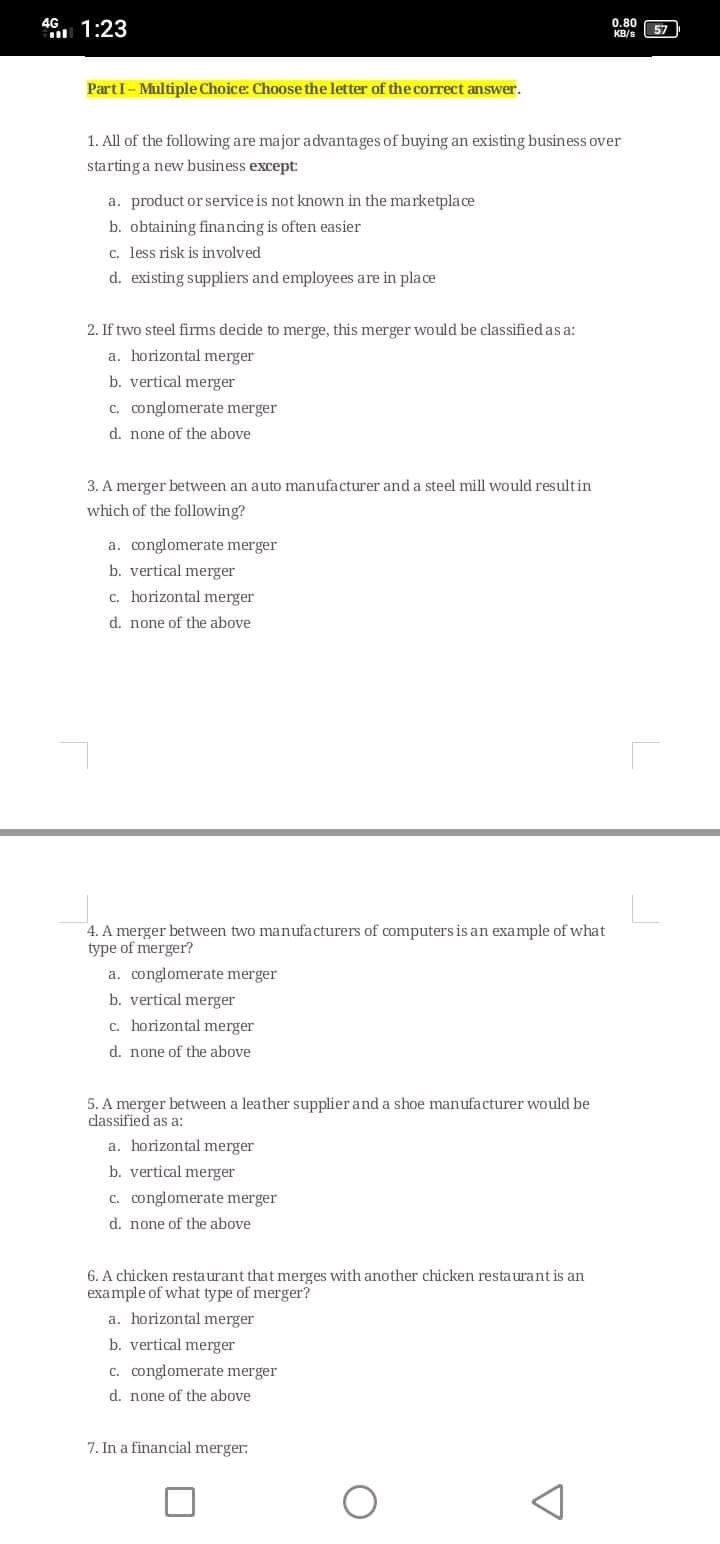

Question: 4G 1:23 0.80 KB/S 57 PartI - Multiple Choice: Choose the letter of the correct answer. 1. All of the following are major advantages of

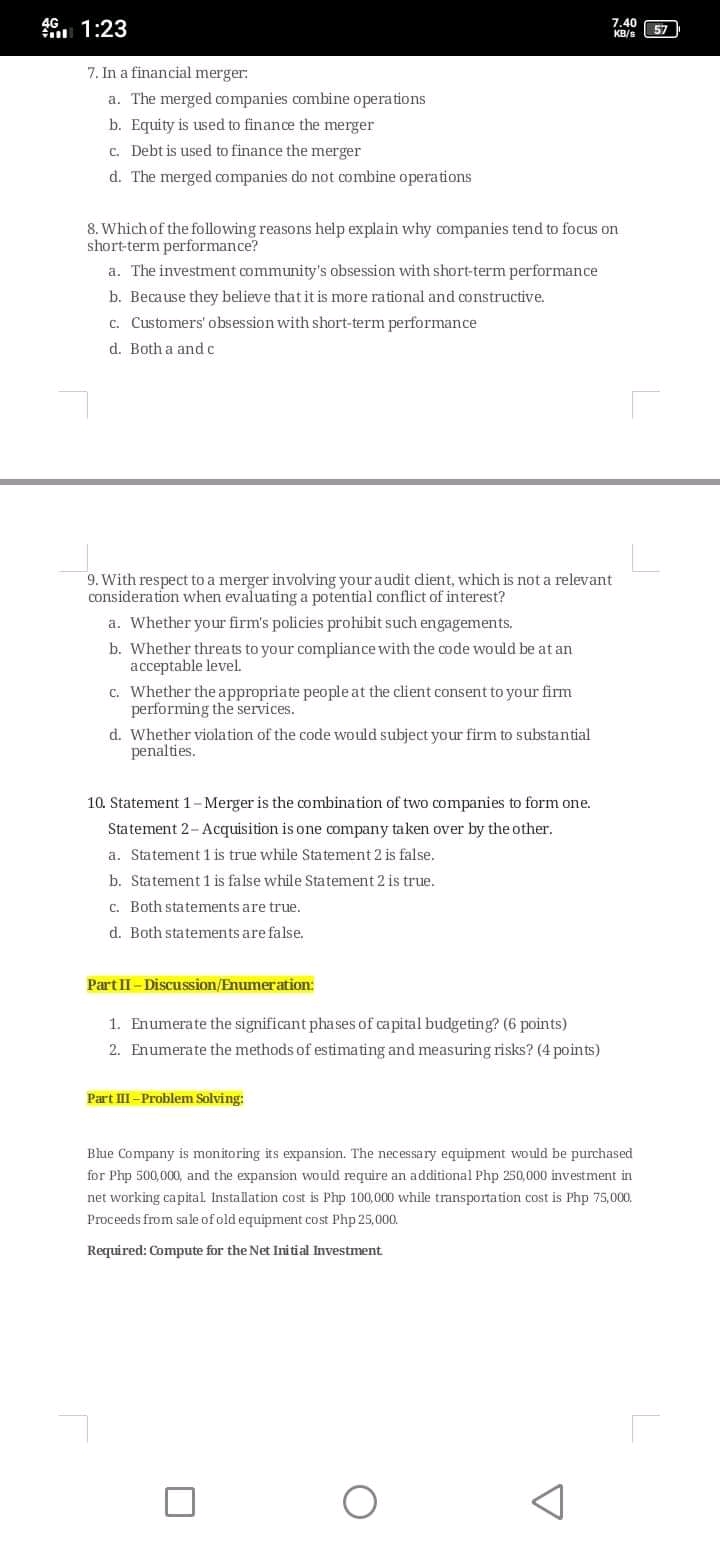

4G 1:23 0.80 KB/S 57 PartI - Multiple Choice: Choose the letter of the correct answer. 1. All of the following are major advantages of buying an existing business over starting a new business except a. product or service is not known in the marketplace b. obtaining financing is often easier c. less risk is involved d. existing suppliers and employees are in place 2. If two steel firms decide to merge, this merger would be classified as a: a. horizontal merger b. vertical merger c. conglomerate merger d. none of the above 3. A merger between an auto manufacturer and a steel mill would resultin which of the following? a. conglomerate merger b. vertical merger c. horizontal merger d. none of the above 4. A merger between two manufacturers of computers is an example of what type of merger? a. conglomerate merger b. vertical merger c. horizontal merger d. none of the above 5. A merger between a leather supplier and a shoe manufacturer would be classified as a: a. horizontal merger b. vertical merger c. conglomerate merger d. none of the above 6. A chicken restaurant that merges with another chicken restaurant is an example of what type of merger? a. horizontal merger b. vertical merger c. conglomerate merger d. none of the above 7. In a financial merger. O4G 1:23 7.40 KB/S 57 7. In a financial merger. a. The merged companies combine operations b. Equity is used to finance the merger c. Debt is used to finance the merger d. The merged companies do not combine operations 8. Which of the following reasons help explain why companies tend to focus on short-term performance? a. The investment community's obsession with short-term performance b. Because they believe that it is more rational and constructive. c. Customers' obsession with short-term performance d. Both a and c 9. With respect to a merger involving your audit dient, which is not a relevant consideration when evaluating a potential conflict of interest? a. Whether your firm's policies prohibit such engagements, b. Whether threats to your compliance with the code would be at an acceptable level. c. Whether the appropriate people at the client consent to your firm performing the services. d. Whether violation of the code would subject your firm to substantial penalties. 10. Statement 1-Merger is the combination of two companies to form one. Statement 2- Acquisition is one company taken over by the other. a. Statement 1 is true while Statement 2 is false. b. Statement 1 is false while Statement 2 is true. c. Both statements are true. d. Both statements are false. Part II - Discussion/Enumeration: 1. Enumerate the significant phases of capital budgeting? (6 points) 2. Enumerate the methods of estimating and measuring risks? (4 points) Part III -Problem Solving: Blue Company is monitoring its expansion. The necessary equipment would be purchased for Php 500,000, and the expansion would require an additional Php 250,000 investment in net working capital. Installation cost is Php 100,000 while transportation cost is Php 75,000, Proceeds from sale of old equipment cost Php 25,000. Required: Compute for the Net Initial Investment 0 O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts