Question: 4G :: 8:27 Done INDIVIDUAL PROJECT_f005efae4... Note: This Project accounts for 40% of the Student Final Grade. Part A: Lease (10 marks) On January 1,

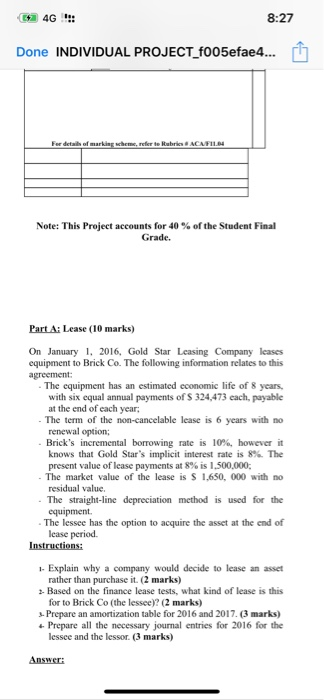

4G :: 8:27 Done INDIVIDUAL PROJECT_f005efae4... Note: This Project accounts for 40% of the Student Final Grade. Part A: Lease (10 marks) On January 1, 2016, Gold Star Leasing Company leases equipment to Brick Co. The following information relates to this agreement: The equipment has an estimated economic life of 8 years, with six equal annual payments of S 324,473 cach, payable at the end of each year, The term of the non-cancelable lease is 6 years with no renewal option: Brick's incremental borrowing rate is 10%, however it knows that Gold Star's implicit interest rate is 8% The present value of lease payments at 8% is 1,500,000 The market value of the lease is $ 1,650,000 with no residual value The straight-line depreciation method is used for the equipment The lessee has the option to acquire the asset at the end of lease period. Instructions: 1. Explain why a company would decide to lease an asset rather than purchase it. (2 marks) > Based on the finance lease tests, what kind of lease is this for to Brick Co (the lessee)? (2 marks) s. Prepare an amortization table for 2016 and 2017. (3 marks) Prepare all the necessary journal entries for 2016 for the lessee and the lessor. (3 marks) Answer: 4G :: 8:27 Done INDIVIDUAL PROJECT_f005efae4... Note: This Project accounts for 40% of the Student Final Grade. Part A: Lease (10 marks) On January 1, 2016, Gold Star Leasing Company leases equipment to Brick Co. The following information relates to this agreement: The equipment has an estimated economic life of 8 years, with six equal annual payments of S 324,473 cach, payable at the end of each year, The term of the non-cancelable lease is 6 years with no renewal option: Brick's incremental borrowing rate is 10%, however it knows that Gold Star's implicit interest rate is 8% The present value of lease payments at 8% is 1,500,000 The market value of the lease is $ 1,650,000 with no residual value The straight-line depreciation method is used for the equipment The lessee has the option to acquire the asset at the end of lease period. Instructions: 1. Explain why a company would decide to lease an asset rather than purchase it. (2 marks) > Based on the finance lease tests, what kind of lease is this for to Brick Co (the lessee)? (2 marks) s. Prepare an amortization table for 2016 and 2017. (3 marks) Prepare all the necessary journal entries for 2016 for the lessee and the lessor

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts