Question: 4.Receiving Unloading and Data Entry: A.600 B.800 C.1000 D.1200 E.1500 5.Inspection A.600 B.800 C.1000 D.1200 E.1500 6.Invoice revision Group of answer choices A.600 B.800 C.1000

4.Receiving Unloading and Data Entry:

A.600

B.800

C.1000

D.1200

E.1500

5.Inspection

A.600

B.800

C.1000

D.1200

E.1500

6.Invoice revision

Group of answer choices

A.600

B.800

C.1000

D.1200

E.1500

7.Staging

Group of answer choices

A.25

B.50

C.100

D.150

E.220

8.Stocking

Group of answer choices

A.25

B.50

C.100

D.150

E.220

9.What are the Activity Expenses for the following Activities in the process for Product A

Invoice revision

Group of answer choices

A.$10,000

B.$15,000

C.$30,000

D.$45,000

E.$60,00

10.What are the Activity Expenses for the following Activities in the process for Product B?

Inspection

Group of answer choices

$80,000

$100,000

$120,000

$160,000

$180,000

11.What are the Total Activity Expenses, under the ABC Method of Allocation, for

Product A?

Group of answer choices

$150,000

$210,000

$280,000

$320,000

$410,000

12.Product B?

Group of answer choices

$210,000

$285,000

$335,000

$415,000

$480,000

13.Acme has decided that the Allocations of the R&W Expenses by the Traditional Method and ABC Method are similar if they are within 10% of each other, and Different if they are greater than 10% apart. Are the results for allocating R&W expenses by the ABC method and the Traditional Method:

Group of answer choices

A.Similar

B.Different

PLEASE HELP!!!

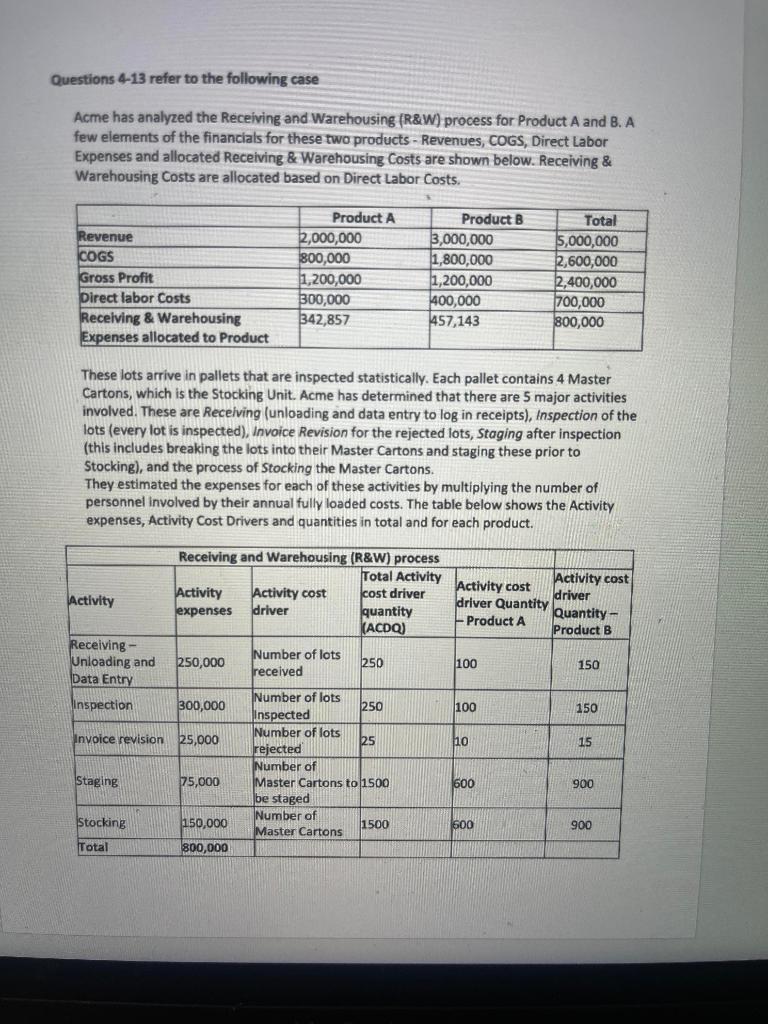

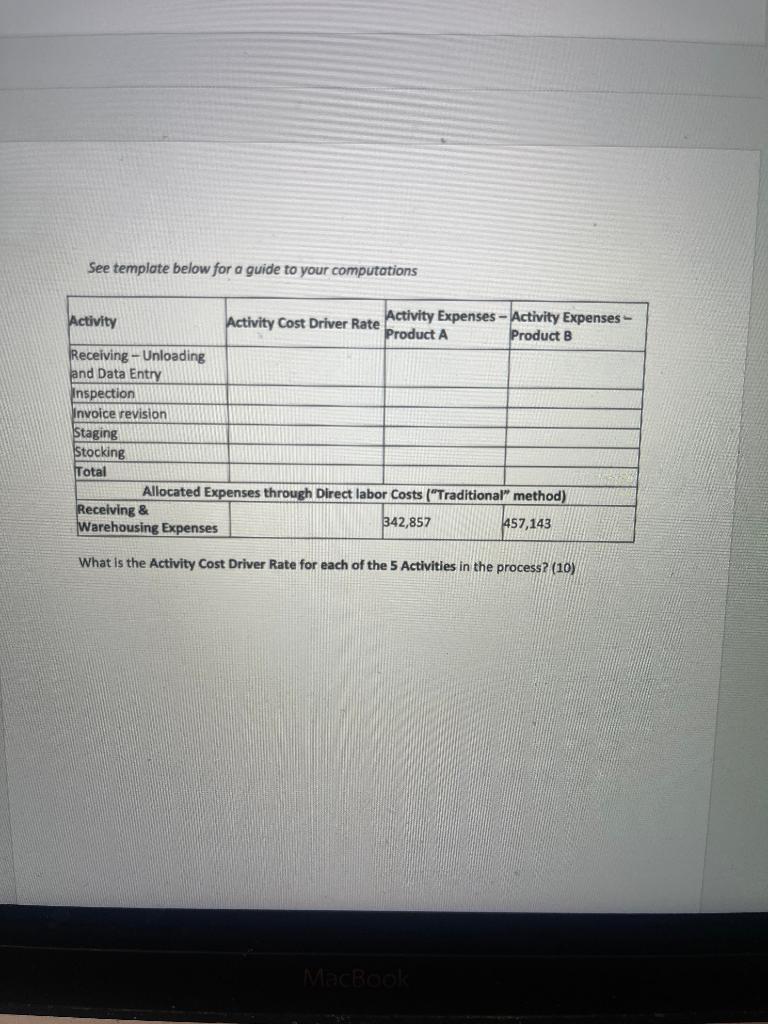

Questions 4-13 refer to the following case Acme has analyzed the Receiving and Warehousing (R\&W) process for Product A and B. A few elements of the financials for these two products - Revenues, COGS, Direct Labor Expenses and allocated Receiving \& Warehousing Costs are shown below. Receiving \& Warehousing Costs are allocated based on Direct Labor Costs. These lots arrive in pallets that are inspected statistically. Each pallet contains 4 Master Cartons, which is the Stocking Unit. Acme has determined that there are 5 major activities involved. These are Recelving (unloading and data entry to log in receipts), Inspection of the lots (every lot is inspected), Invoice Revision for the rejected lots, Staging after inspection (this includes breaking the lots into their Master Cartons and staging these prior to Stocking), and the process of Stocking the Master Cartons. They estimated the expenses for each of these activities by multiplying the number of personnel involved by their annual fully loaded costs. The table below shows the Activity expenses, Activity Cost Drivers and quantities in total and for each product. See template below for a guide to your computations What is the Activity Cost Driver Rate for each of the 5 Activities in the process

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts