Question: 4.SHORT ANSWER. Write the word or phrase that best completes each statement or answers the question. 4.1 How much should you pay for a bond

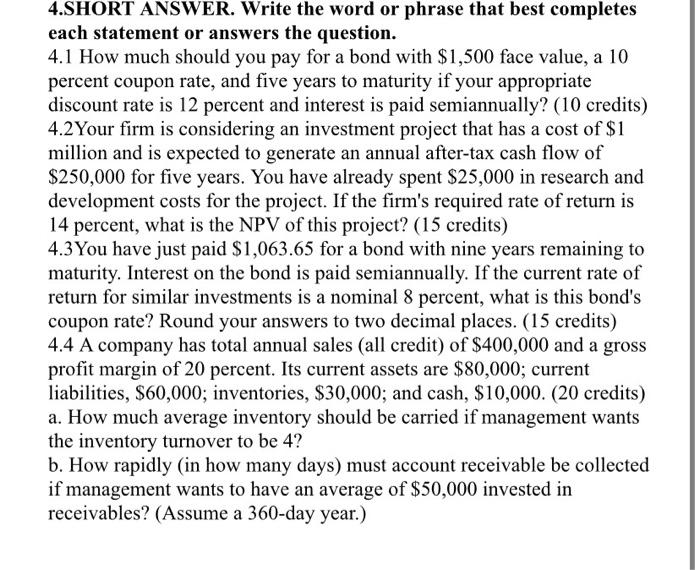

4.SHORT ANSWER. Write the word or phrase that best completes each statement or answers the question. 4.1 How much should you pay for a bond with $1,500 face value, a 10 percent coupon rate, and five years to maturity if your appropriate discount rate is 12 percent and interest is paid semiannually? (10 credits) 4.2 Your firm is considering an investment project that has a cost of $1 million and is expected to generate an annual after-tax cash flow of $250,000 for five years. You have already spent $25,000 in research and development costs for the project. If the firm's required rate of return is 14 percent, what is the NPV of this project? (15 credits) 4.3 You have just paid $1,063.65 for a bond with nine years remaining to maturity. Interest on the bond is paid semiannually. If the current rate of return for similar investments is a nominal 8 percent, what is this bond's coupon rate? Round your answers to two decimal places. (15 credits) 4.4 A company has total annual sales (all credit) of $400,000 and a gross profit margin of 20 percent. Its current assets are $80,000; current liabilities, $60,000; inventories, $30,000; and cash, $10,000. (20 credits) a. How much average inventory should be carried if management wants the inventory turnover to be 4 ? b. How rapidly (in how many days) must account receivable be collected if management wants to have an average of $50,000 invested in receivables? (Assume a 360-day year.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts