Question: 4th question 2. Fall Tyme, Inc., is considering a new three year expansion project that requires an initial fixed asset investment of $3.9 million. The

4th question

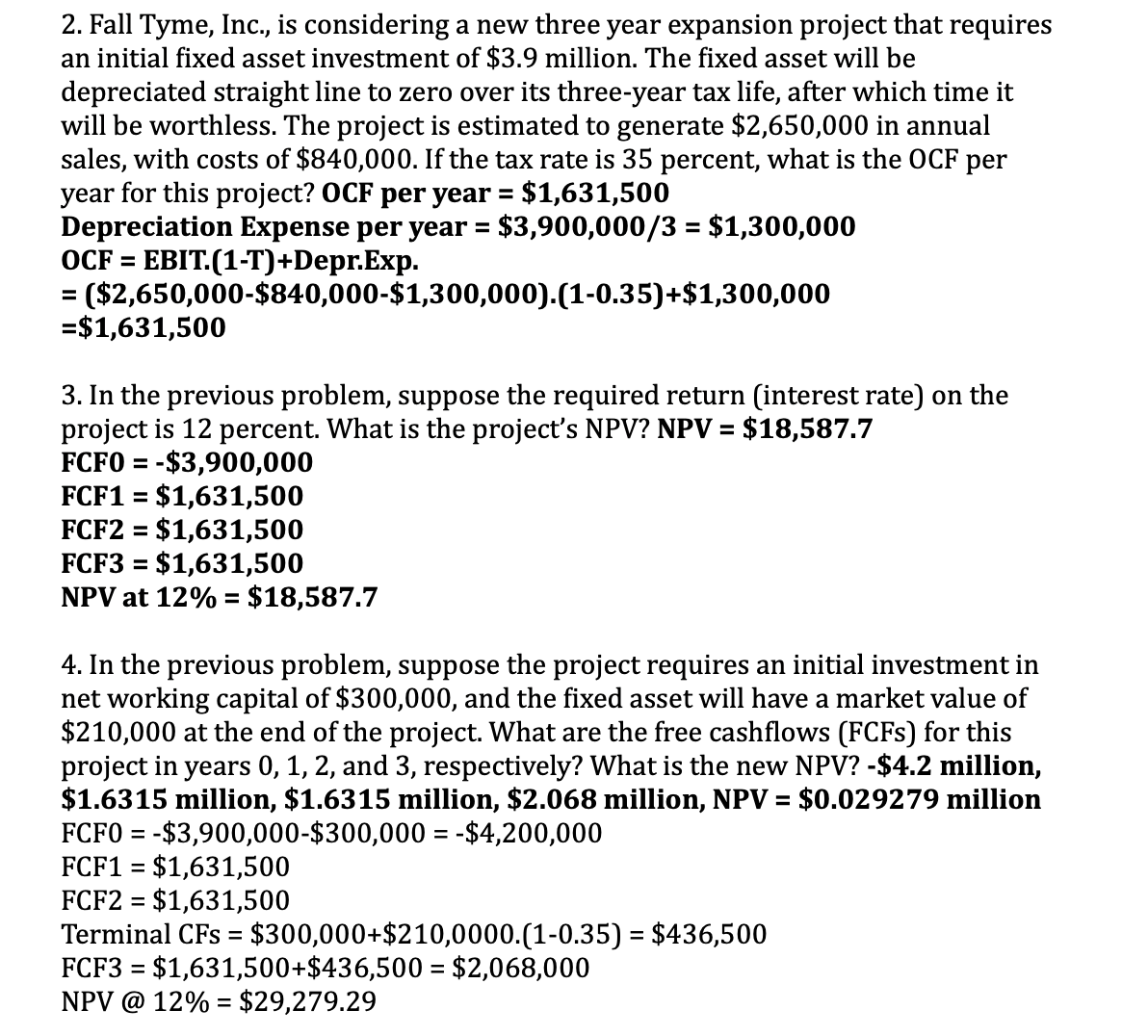

2. Fall Tyme, Inc., is considering a new three year expansion project that requires an initial fixed asset investment of $3.9 million. The fixed asset will be depreciated straight line to zero over its three-year tax life, after which time it will be worthless. The project is estimated to generate $2,650,000 in annual sales, with costs of $840,000. If the tax rate is 35 percent, what is the OCF per year for this project? OCF per year =$1,631,500 Depreciation Expense per year =$3,900,000/3=$1,300,000 OCF = EBIT.(1-T)+Depr.Exp. =($2,650,000$840,000$1,300,000)(10.35)+$1,300,000 =$1,631,500 3. In the previous problem, suppose the required return (interest rate) on the project is 12 percent. What is the project's NPV? NPV =$18,587.7 FCF0=$3,900,000FCF1=$1,631,500FCF2=$1,631,500FCF3=$1,631,500 NPV at 12%=$18,587.7 4. In the previous problem, suppose the project requires an initial investment in net working capital of $300,000, and the fixed asset will have a market value of $210,000 at the end of the project. What are the free cashflows (FCFs) for this project in years 0,1,2, and 3 , respectively? What is the new NPV? -\$4.2 million, $1.6315 million, \$1.6315 million, \$2.068 million, NPV = \$0.029279 million FCF0=$3,900,000$300,000=$4,200,000 FCF1=$1,631,500 FCF2=$1,631,500 Terminal CFs =$300,000+$210,0000.(10.35)=$436,500 FCF3=$1,631,500+$436,500=$2,068,000 NPV @ 12%=$29,279.29

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts