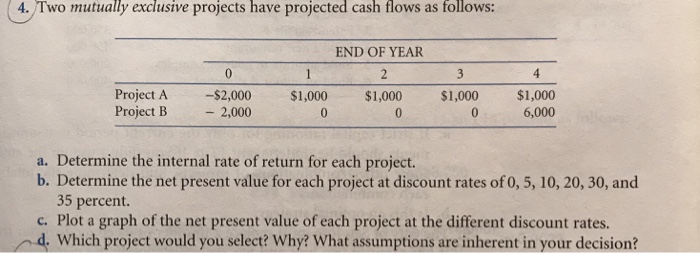

Question: 4Two mutually exclusive projects have projected cash flows as follows: END OF YEAR 4 Project A $2,000 ,000 $1,000 $%1,000 $1,000 Project B 2,000 6,000

4Two mutually exclusive projects have projected cash flows as follows: END OF YEAR 4 Project A $2,000 ,000 $1,000 $%1,000 $1,000 Project B 2,000 6,000 a. Determine the internal rate of return for each project. b. Determine the net present value for each project at discount rates of 0, 5, 10, 20, 30, and Pot raph proseat valuc of sich rojet a he dlferunt dicount rates 35 percent. Which project would you select? Why? What assumptions are inherent in your decision

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts