Question: $ 5 0 4 , 0 0 0 ; Alonso, capital ( 5 0 per ent of profits and losses ) , $ 1 5

$; Alonso, capital perent of profits and losses $; Mann, capital percent $;; uzukl, capital percent $ The following transactions occur during liquidation:

Noncash assets with a book value of $ are sold for $ in cash.

A creditor reduces his claim against the partnership from $ to $ and this amount is paid in cash.

The remaining noncash assets are sold for $ in cash.

The remaining liabilities of $ are paid in full.

Liquidation expenses of $ are paid in cash.

Cash remaining after the above transactions have occurred is distributed to the partners.

Required:

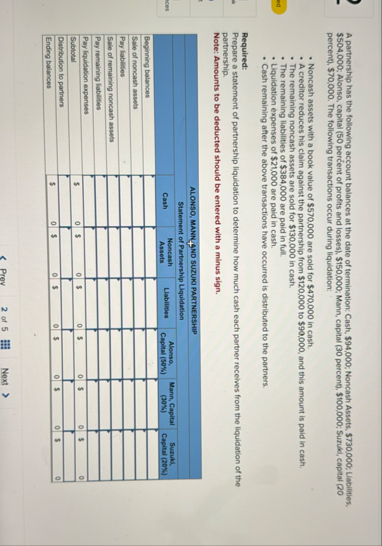

Prepare a statement of partnership liquidation to determine how much cash each partner recelves from the liquidation of the partnership.

Note: Amounts to be deducted should be entered with a minus sign.

tableALONSO MANN ND SUZUKI PARTNERSHIPStatement of Partnership LiquidationCash,Noncash Assets,Labilities,Alonso, Capital Mann, Capital Suriki, Capital Beginning balances,,,,,,Sale of noncash assets,,,,,,Pay labilites,,,,,,Sale of remaining noncash assets,,,,,,Pay remaining labilites,,,,,,Pay liquidaton expenses,,,,$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock