Question: $ 5 1 0 , 0 0 0 Table 8 . 3 Depreciation under Modified Accelerated Cost Recovery System ( MACRS ) actually carries over

$ Table Depreciation under Modified Accelerated Cost Recovery System MACRS

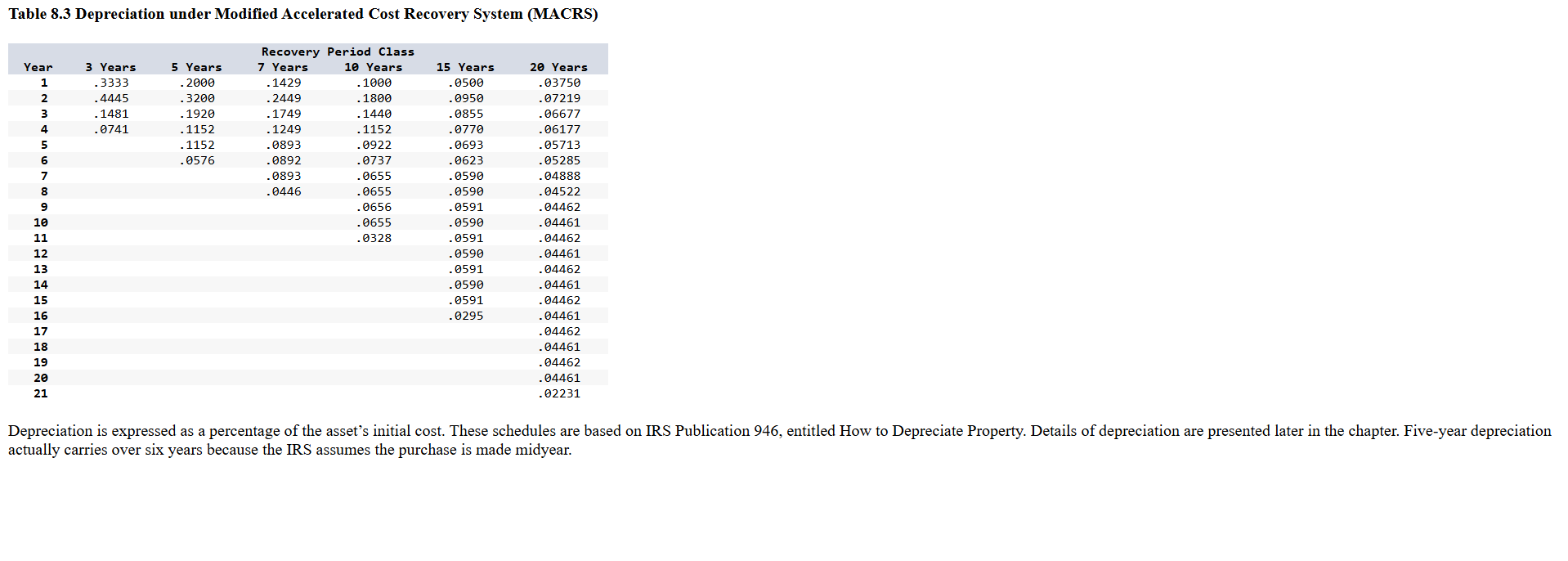

actually carries over six years because the IRS assumes the purchase is made midyear. Table Depreciation under Modified Accelerated Cost Recovery System MACRS actually carries over six years because the IRS assumes the purchase is made midyear.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock