Question: 5 1 : 5 1 Time Remaining Multiple Choice 3 points Megan prepared a Federal income tax retarn for Joan for compensation. Joan's reharn included

:

Time Remaining

Multiple Choice points

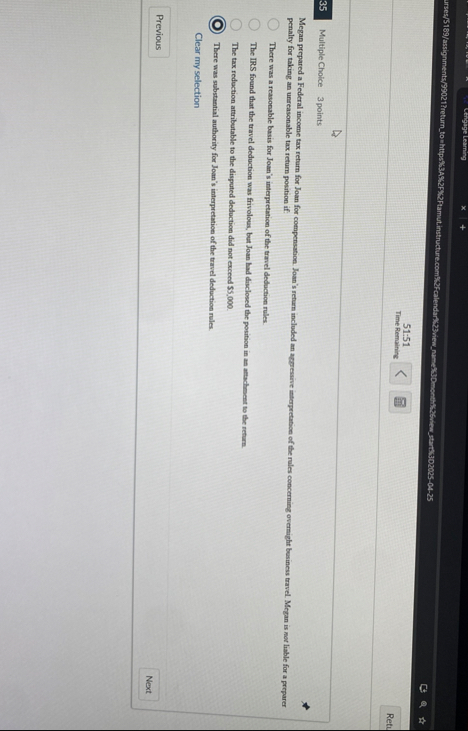

Megan prepared a Federal income tax retarn for Joan for compensation. Joan's reharn included an agepessive imtopretation of the rules concerning overnight business travel. Megan is not lable for a preparer penalty for taking an unreasonable tax return position if:

There was a reasonable basis for Joan's interpretation of the travel deduction rules.

The IRS found that the travel deduction was frivolous, but Joan had disclosed the position in an amachment to the return

The tax reduction attributable to the disprated deduction did not exceed

There was substantial authority foe Joan's interpretation of the travel deduction reles.

Clear my selection

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock