Question: 5. (10 pt) Given the issues discussed in Question 4 above, some people look at the current yield (rate) of 10-year treasury bonds instead and

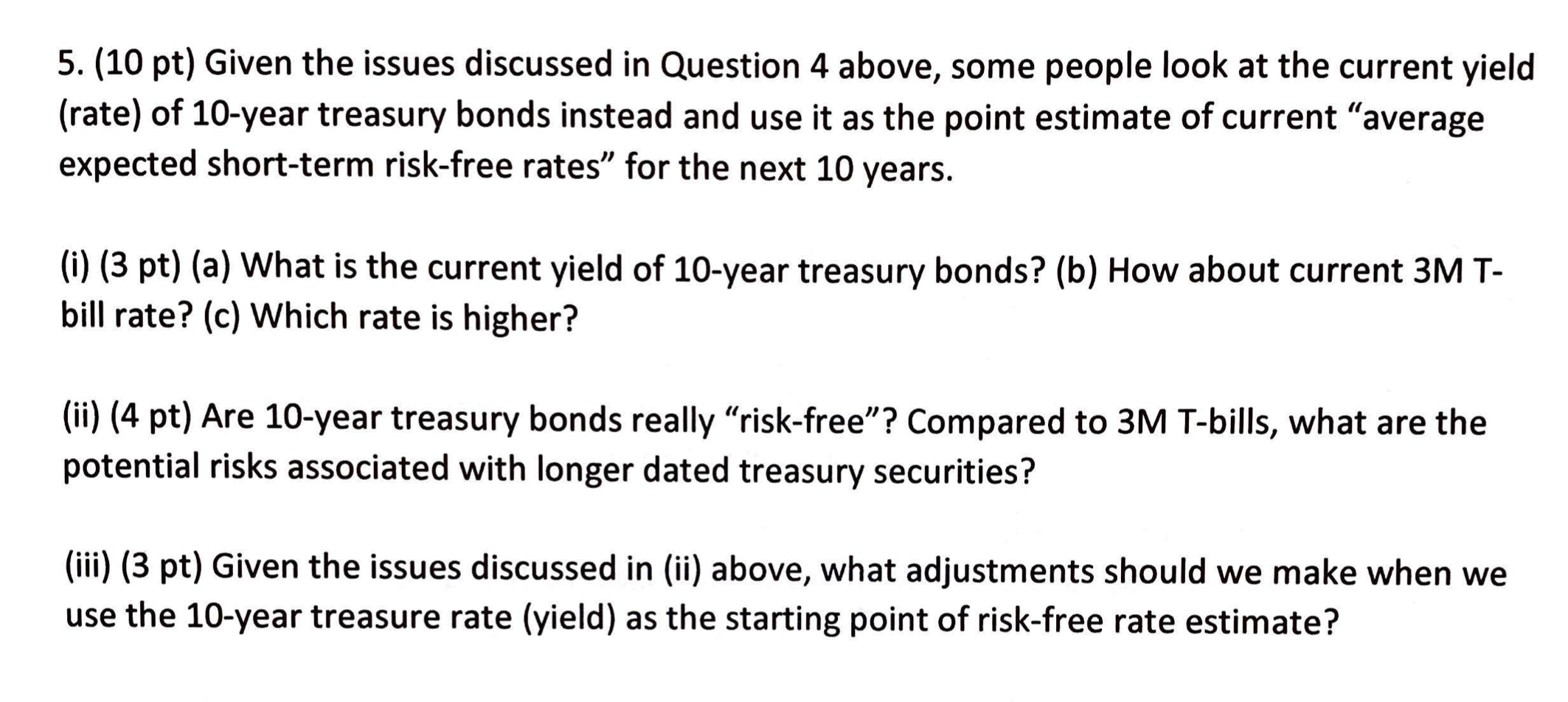

5. (10 pt) Given the issues discussed in Question 4 above, some people look at the current yield (rate) of 10-year treasury bonds instead and use it as the point estimate of current average expected short-term risk-free rates for the next 10 years. (i) (3 pt) (a) What is the current yield of 10-year treasury bonds? (b) How about current 3M T- bill rate? (c) Which rate is higher? (ii) (4 pt) Are 10-year treasury bonds really risk-free? Compared to 3M T-bills, what are the potential risks associated with longer dated treasury securities? (iii) (3 pt) Given the issues discussed in (ii) above, what adjustments should we make when we use the 10-year treasure rate (yield) as the starting point of risk-free rate estimate? 5. (10 pt) Given the issues discussed in Question 4 above, some people look at the current yield (rate) of 10-year treasury bonds instead and use it as the point estimate of current average expected short-term risk-free rates for the next 10 years. (i) (3 pt) (a) What is the current yield of 10-year treasury bonds? (b) How about current 3M T- bill rate? (c) Which rate is higher? (ii) (4 pt) Are 10-year treasury bonds really risk-free? Compared to 3M T-bills, what are the potential risks associated with longer dated treasury securities? (iii) (3 pt) Given the issues discussed in (ii) above, what adjustments should we make when we use the 10-year treasure rate (yield) as the starting point of risk-free rate estimate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts